EXECUTIVE SUMMARY

May 15, 2026. Jerome Powell’s term as FED Chair is up on May 15, 2026. He has made it clear that he seeks an anti-Burns legacy, and given the unlikelihood of his renomination he has little choice but to engineer a hard landing in order to ensure inflation is brought durably back to the Fed’s 2% target.

Soft Landing Formation. The US economy is currently in a “soft landing” formation: nominal growth has slowed to almost 5%, real growth is over 2%, inflation has fallen to almost 3%, and the unemployment rate is under 4%. Financial markets are ebullient about the prospect of the Fed launching a rate cut cycle in 1H24 in order to softly land the plane.

Structural Inflation Powder Keg. The problem with a soft landing attempt is the Structural Inflation Powder Keg that sits beneath the US economy: at circa 4% YoY core nonhousing services PCE inflation (i.e. “supercore”) is running well above the Fed’s 2.5-3% target, wage growth is north of 4% YoY, and the federal deficit is projected to run at 5-10% of GDP for the foreseeable future. A growth/market-friendly easing of monetary policy in 1H24 would light the fuse.

“Tighter for Longer”. Despite consistently floating the possibility of a soft landing, the Fed has been explicit in its intention to maintain “tighter for longer” monetary policy until it is “confident” inflation is on its way durably back to 2%, defined as supercore inflation returning to its pre-pandemic level of 2.5-3%. With supercore running above 4%, the Fed guiding to rate cuts no earlier than 2H24, and the Fed by default hesitant to adjust policy so close to an election, rate cuts are highly unlikely in 2024 outside of a material recession.

December 18, 2024. The December 18, 2024 FOMC meeting, the first post-election, is a critical event. If the economy avoids a “hard” or “no” landing in 2024, and supercore inflation is back to 2.5-3%, by the December 2024 FOMC meeting the economy will be in a position for the Fed to engineer either a “soft” or “hard” landing in 2025. In this scenario, if the Fed starts cutting the first chance it gets post-election that will signal two things: 1) the Fed is truly going for a soft landing, and 2) Powell is not seeking to cement an anti-Burns legacy. Conversely, if the Fed holds Fed Funds steady at the December 2024 FOMC despite supercore inflation sitting at target, that will be a clear signal Powell is going for a hard landing in order to cement his anti-Burns legacy.

Election-to-Election. If Powell goes for the hard landing in 2025, the base case outlook for SPX is a recessionary bear market decline alongside a breakout in YoY initial jobless claims above 20%. This bear market likely runs from Election Day 2024 to Election Day 2025, taking SPX down to 10-15 times $200 earnings.

Goldilocks. In the near-term, the interaction of long-term UST yields, the direction of US economic data, and investor positioning is key. With 5y5y TIPS break-evens back in the Fed’s comfort zone the threat of hawkish FED guidance cutting off the on-going “Goldilocks” rally in equities is neutralized. Until investor positioning fully reflects the Goldilocks condition of falling long-term UST yields alongside moderating economic growth, SPX can continue higher into early 2024.

Growth Scare. However, the US economy is deep into the “long and variable lags” zone of this tightening cycle. Despite the recent growth-friendly easing of financial conditions since late October, labor market indicators and default rates suggest the economy is weaker than it appears. Not only is the equity market likely to face a “growth scare” event in 1H24 that takes SPX down to 3840-4300, there is a not-insignificant risk of a hard landing in 2024 that would render moot the entire thesis outlined above. However…

Yellen/Brainard. Treasury Secretary Janet Yellen and NEC Director Lael Brainard have over $1 trillion of QE firepower sitting in the TGA and RRP, and a US Treasury buyback program waiting in the wings. With the Fed likely on hold at 525-550 until the December FOMC, Yellen/Brainard’s tools will be all the more potent. If SPX falls in 1H24 on a growth scare, odds are high they will seek to engineer a powerful stock market rally into Election Day 2024.

POWELL’S LEGACY

Discussion

FED Chair Jerome Powell’s term as Chair ends 2.5 years from now on May 15, 2026. This date is the single most important structural variable in markets today.

With “supercore” PCE inflation running above 4% YoY, wage growth running at 4-5%, the federal deficit running at 5-10% of GDP, the global green energy transition well underway, a structural shortage in core commodity production capacity in place, globalization stalled, if not going in reverse, and the entire TIPS break-evens curve above 2%, Powell’s legacy delicately rests on a powder keg of structural inflation pressure.

If Powell knew today that he would be re-nominated on 5/15/2026, he could take the long view and opportunistically ease policy in order to attempt the oft-discussed soft landing knowing that if inflation doesn’t durably come back to target in a soft landing that he has until 5/15/2030 to save his legacy. But he doesn’t have that luxury.

If Biden wins a second term it is unlikely Powell will be re-nominated, as a deficit-laden economic agenda will demand a loosening of monetary policy; and it is far from guaranteed that a Republican president would re-nominate Powell, as Republicans could make the case that inflation got out of hand on Powell’s watch (price stability is, after all, “the responsibility of the Federal Reserve” as Powell so frequently states) and that Powell allowed it to become embedded by accommodating Treasury Secretary Janet Yellen’s aggressive use of the Treasury Bill market to directly counteract the Fed’s tightening program. As such, Powell has little choice but to conduct monetary policy as if he has until 5/15/2026 to cement an anti-Burns legacy.

The upshot is that Powell is likely to hold the Fed Funds Rate steady at 525-550 and continue running down the balance sheet for the next 2.5 years…unless the US economy enters a downturn deep enough to allow monetary policy to be eased without igniting the “structural inflation powder keg”.

Given POTUS Election year dynamics and the slow-moving nature of “opportunistic disinflation” monetary policy, it’s unlikely the US enters a deep economic downturn in 2024; but as the lags of tightening begin to really filter through the economy on the back of the first major wave of corporate refinancing activity, it’s also unlikely the Fed will need to raise rates again in 2024 even if inflation settles out above 3%. This leaves the outlook for monetary policy as “UNCH” for 2024 with the Fed exiting the year sitting on a 525-550 Fed Funds and a balance sheet that’s upwards of $1 trillion smaller.

The full weight of Powell’s tightening program likely hits the US economy in 2025, underwriting a severe final leg of the S&P 500 bear market that’s been in place since January 4, 2022. By the end of 2025 the SPX net profit margin and valuation normalization process should largely be complete, setting the market up to begin a powerful new bull market in anticipation of a more dovish FED Chair to take the helm on 5/15/2026 and the attendant economic/market impact of easier monetary policy.

Importantly, this outlook does not at all imply that SPX moves in a straight line lower from here until 12/31/2025, as both 2024 and 2025 are likely to be extraordinarily volatile in both directions.

Exhibits

The Structural Inflation Powder Keg:

“Supercore” PCE inflation is running above 4%

Wage growth is running at 4-5%

The US fiscal deficit is running at 5-10%

And the entirety of the TIPS break-even curve is above 2%

SOFT LANDING FORMATION

Discussion

The November 2022 SPX outlook titled “Navigating the Return to Normal” outlined the following set of “normalized” conditions likely to result from the Fed’s mission to bring inflation durably back to its 2% target:

Inflation: 3%

Rationale: “Due to the fact the key forces that kept inflation low and stable for the last 30 years appear to be going in reverse (globalization, cheap energy, and cheap labor), it's plausible that the Fed will declare a victory of sorts once headline CPI sustainably falls to 3%, as forcing it down to 2-2.5% might require an unacceptably high unemployment rate.”

Fed Funds: 4%

Rationale: “…because 3% would still be above target, Fed policy over the next economic cycle is likely to look nothing like the low rate environment of the last 10-20 years. Normalization of Fed policy once CPI reaches 3% could very well entail moving the currently projected terminal Fed Funds Rate (FFR) of 5% down to 4%, which would keep a 1% real FFR in place as an insurance policy against inflation turning back up in the next economic upswing.”

UST 10s: 5%

Rationale: “Over the very long-term, the 10-year US Treasury yield has on average traded 200 bps above YoY CPI inflation. As such, in a world of steady 3% CPI inflation, the 10-year should be expected to trade around 5%.”

UST 2s: 4.09%

Rationale: “…over the very long-term, the 10y-2y curve has averaged a spread of 91 bps, which would put the ‘normal’ 2-year at around 4.09% assuming a 5% 10-year.”

SPX Net Margin & P/E: 9.4% and 17.5x

Rationale: “The SPX net profit margin (NPM) has climbed steadily higher over time, peaking at 7.4% in 2000, 8.6% in 2007, 10.2% in 2019, and 12.9% in 2022. A reversion back to the 2000 peak of 7.4% is likely too severe, but a return to somewhere between the 2007 and 2019 peaks (circa 9.4%) is very appropriate for a world of higher inflation, interest rates, and cost of labor. Also appropriate for this higher cost world is for the SPX P/E to fall to its long-term average of 17.5x. Applying a normalized NPM of 9.4% to current Wall Street estimates for 2024 SPX sales per share ($1873.10) yields normalized EPS of $176 in 2024. At 17.5 times $176, the SPX fair value by the end of 2024 is circa 3080.

At the time of the November 2022 write-up the weight of the cross-asset market evidenced pointed straight toward the US economy entering recession in 2023. Based on this recessionary outlook and Fed Funds futures pricing in place at the time, the thesis was that the bulk of this normalization process would occur over the course of 2023 and into 2024.

Instead, through October 2023 the US economy has approached the runway in a picture-perfect soft landing formation: inflation fell from 7.8% to 3.2% alongside a deceleration in nominal final sales growth from 8.4% to 5.6%, while real final sales accelerated from 1.7% to 2.1% and the unemployment rate ticked up slightly from 3.7% to 3.9%.

Over the course of this soft landing “approach” the economic and financial market normalization process has continued…

Inflation: 3.2% versus the 3% “normalized” level published last November

Fed Funds: 5.25% versus the 4% steady-state target published last November

Real UST 10s: 1.69% as of October 31 versus the 1.97% long-term average published as a “normalized” target last November1

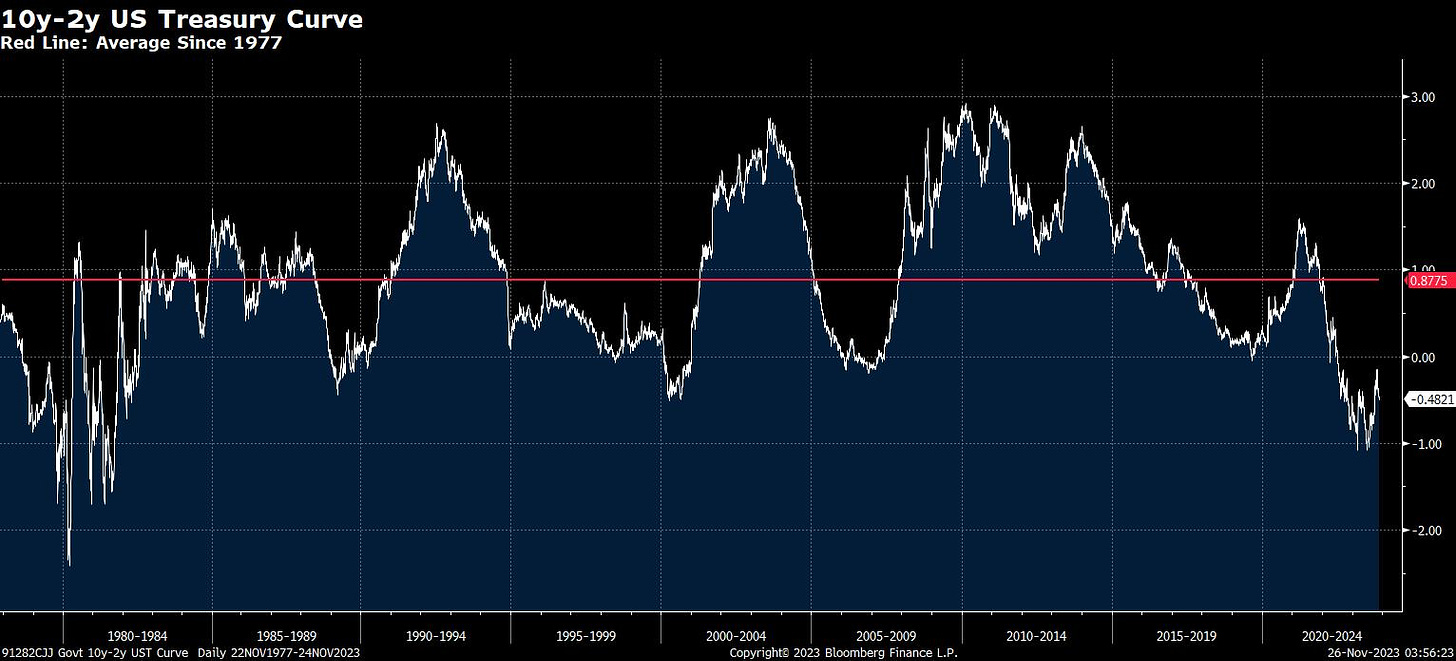

10-2 UST Curve: -48 bps versus the +88 bps long-term average published as a “normalized” target last November2

SPX Net Margin: 11.43% on an LTM basis as of June 30, down from 12.32% on an LTM basis as of June 30, 2022 and closer to a more conservative mid-cycle target of 10.64% than the 9.4% published last November3

SPX P/E: 21.9 times June 30 LTM EPS, up from the 19.34x on June 30, 2022 LTM EPS as of November 28, 2022 and farther away from the 17.5x “normalized” P/E published last November4

…But is by no means complete, as the Fed can only declare soft landing victory once it has cut Fed Funds back to a sensible range of neutral without the US economy entering recession.

The problem with this soft landing attempt is the Structural Inflation Powder Keg discussed in the prior section above. If the Fed attempts to “land the plane” by starting a rate cut cycle in the first half of 20245, it is likely that economic growth and inflation would reaccelerate higher on the back of higher asset prices and deficit spending.

Exhibits

YoY CPI fell from 7.8% to 3.2% over the last year…

…On the back of a sharp deceleration in nominal growth, as measured by YoY final sales falling from 8.4% to 5.6%.

Meanwhile, real final sales accelerated from 1.7% to 2.1% while the unemployment rate ticked up slightly from 3.7% to 3.9%.

Normalization in process: real UST 10s have largely normalized, but the 10-2 UST curve remains inverted due to “higher for longer” monetary policy; and the SPX net margin continues to grind its way back to normalized mid-cycle levels.

TIGHTER FOR LONGER

Discussion

While financial markets are currently celebrating the prospect of a soft landing predicated on growth/market-friendly easing of monetary policy, the fact of the matter is this: Not only has the Fed clearly and consistently communicated “tighter for longer” growth/market-unfriendly policy, but the very actions the Fed has taken - principally holding Fed Funds at 525-550 and “proceeding carefully” - that have caused financial markets to anticipate a soft landing have only served to confirm this “tighter for longer” policy approach.

All throughout 2022 and into 2023 the Fed said that it would eventually start cutting interest rates even if inflation was still above 2%, as long as it was confident inflation was durably on its way back to 2% and inflation expectations remained well-anchored. This soft landing messaging went a long way toward underwriting the soft landing consensus narrative and positioning in place today. And yet, here we are: CPI just printed 3.2%, economic supply and demand have come into better balance as evidenced by decelerating nominal growth, inflation expectations remain well-anchored, and Fed Funds is well above any sensible definition of neutral relative to current 2-year TIPS break-even inflation expectations6 - yet the Fed is guiding to a “higher for longer” rate path that would entail rate cuts no sooner than 2H24.

So, “tighter for longer”. But until when? And what happens to the economy and financial markets until then?

The “when?” is pretty straightforward. Enter:

The “Confidence” Framework

Both the Fed’s words and actions make it quite clear when rate cuts would become appropriate: once they are “confident the job is done.”

In the lead-up to Jackson Hole 2022, former FRB New York President Bill Dudley kicked off a FED communication blitz that paved the way for Powell’s now-infamous “pain” speech, detailing in a July 14, 2022 Bloomberg op-ed how the Fed would be “hesitant to stop tightening until they’re highly confident that they’ve done enough.” Powell reiterated the “confidence” framework in his Jackson Hole speech, closing with: “We will keep at it until we are confident the job is done.”

For over a year following Dudley’s op-ed the Fed was intentionally vague about the definition of “confident”. But in an August 10, 2023 interview with Yahoo! Finance, FRB San Francisco President Mary Daly defined confident in very specific terms:

“We do need to see that [core nonhousing services inflation (i.e. ‘supercore’)] come back to pre-pandemic levels if we’re going to be confident that we can get to 2% on a sustainable basis.”

There is still some interpretation needed here. One, does Daly mean the YoY rate of “supercore” inflation, or perhaps a string of 3-6 months of MoM prints that are in line with pre-pandemic levels? And two, is she referring to the Fed waiting until pre-pandemic levels to lower Fed Funds from the terminal level, or would the Fed start cutting once progress is underway and then complete the normalization of Fed Funds back to neutral once supercore inflation has reached pre-pandemic levels?

Regarding question #2, just after the key sentence cited above she goes on to say:

“I’m going to need to see some traction in getting there before I feel comfortable that we’ve done enough.”

This means she is waiting for traction before declaring the Fed is at a “sufficiently restrictive” level, after which the key question becomes for how long to hold rates at that level. It’s only logical that the pre-pandemic level of supercore inflation is the gateway to non-recessionary cuts off the terminal Fed Funds rate.

Regarding #1, nitpicking between a string of MoM readings versus the YoY level misses the forest from the trees. Powell has referred to YoY inflation readings enough to know that the YoY change in supercore inflation gets you at least 75% of the way there to framing the path to rate cuts.

Critically, FED action supports their guidance that they will not cut rates until supercore inflation returns to pre-pandemic levels, making the “surgical rate cuts” projected by so many lately very unlikely.

Surgical Rate Cuts

The Fed has routinely guided to the notion that it could cut rates not to ease policy but to maintain a constant level of real Fed Funds, and it’s this “maintenance cuts” framework that led Joseph Wang to recently project the first rate cut to come at the March 2024 FOMC meeting.

Powell himself defines real Fed Funds as the policy rate minus 1-2 year forward inflation expectations. Using this definition and the 2-year TIPS break-even, the current real Fed Funds rate is 318 bps, over the 300 mark where it’s been since the Fed hiked in May and again in July…all of which suggests the Fed is comfortable being over 300.

The key problem with 1H24 surgical cuts projection is that the 2-year break-even is just 214 bps and unlikely to move lower in the coming months - outside of a growth/market-unfriendly development - given low oil/gasoline prices and over a year of disinflation now working its way through base effects for 1-2 year ahead CPI inflation.

So, it can be stated with reasonably high confidence that the Fed will not cut rates outside of a material recession until supercore inflation is back to pre-pandemic level of 250-300. Now the question is: What happens to the economy and financial markets on the way to 250-300?

THE ECONOMY

Scenario Analysis

With the Fed guiding to 2H24 rate cuts at the earliest, and by default hesitant to adjust policy ahead of an election, the fact PCE supercore inflation is running well above the 250-300 level7 the Fed would need to see to be confident it could safely start cutting rates all but guarantees the Fed will not start cutting rates before its December 18, 2024 FOMC meeting (the first FOMC meeting post-election) unless the economy enters a material recession in the first half of 2024. This leaves us with a clean scenario analysis path looking out to December 2024:

If supercore PCE is back to pre-pandemic levels (250-300) with the unemployment rate 400-500 by the December 2024 FOMC meeting, the Fed’s urgency to cut the first chance it gets post-election will say a lot about Powell’s seriousness about his legacy and likely determine whether the economy experiences a soft or hard landing in 2025 (“likely” because if the economy is in a self-reinforcing downturn by December 2024, a soft landing may no longer be possible even if the Fed starts cutting rates).

Below is a crude sketch of the path Powell takes Fed Funds from the December 2024 FOMC to his last meeting in April/May 2026 under the four scenarios discussed above, as well as a rough pass at what the economy looks like on his last day as Chair (May 15, 2026).

Probabilities

So much of this is guesswork at this point given the “reflexivity” of the various cross-asset market forces at play, but sitting here today the probability of a soft or hard landing looks 50/50 given the likelihood it will be determined by FED action. As discussed above, if the economy goes into the December 2024 FOMC meeting in a self-reinforcing downturn, then it’s unlikely the Fed will be able to engineer a soft landing; but Treasury action ahead of the election is likely to keep the self-reinforcing downturn at bay, so a soft landing is very much in the cards, of course pending Powell’s seriousness about his legacy.

The risk of a crash landing looks exceedingly low given the disinflationary process underway and the slow-moving nature of this cycle as a result of the well-covered “excess consumer savings” dynamic. So, for the sake of easy math call it 0%. The more likely non-soft/hard landing scenario is a “no landing”. If the Fed stays on hold, disinflation stalls, and Treasury keeps asset prices and in turn consumer sentiment elevated into the election, the economy could easily reaccelerate out of a 4Q23/1Q24 slowdown, keeping supercore inflation at 300-350 and the unemployment rate below 400. Call it 30%. In total, the probabilities look as follows:

No Landing: 30%

Soft Landing: 35%

Hard Landing: 35%

Crash Landing: 0%

Projections

THE MARKET

The Path to 2026

Beyond the near-term noise of FED communication, macro data, and market positioning, the outlook to the second half of 2025 is reasonably straight forward as long as Powell remains committed to cementing an anti-Burns legacy. Working backwards…

May 15, 2026: Odds are Powell will be replaced with a more dovish FED Chair. If Biden/Democrats win the White House, it’s 100%. If Trump wins, it also might be 100% given Trump’s love of ZIRP and his history with Powell. The only real chance of Powell being replaced with a Chair as hawkish as him is if a hard-money Republican wins in 2024, which really isn’t at all in the cards right now. So, for market analysis purposes it’s best to plan for a more dovish Chair in mid-2026.

Q4 2025: Given the equity market’s leading tendencies around major inflection points, one should assume SPX starts to price in a more dovish, market/economy-friendly FED Chair some time in the fourth quarter of 2025.

Election-to-Election: As discussed above, by the time the Fed sits down for its first post-election FOMC meeting in December 2024 the US economy will likely be at a crossroads: either it will have reaccelerated into a “no landing” formation that forces the Fed to restart a new hiking cycle that takes Fed Funds up another 100 bps to 625-650, or it will be in a position for the Fed to start cutting interest rates. How the Fed approaches rate cuts will likely determine whether the economy experiences a soft or hard landing in 2025. Given Powell’s desire to cement an anti-Burns legacy, the base case outlook for the economy and stock market in 2025 is a classic recessionary bear market that takes the S&P 500 down to a range of 10-15x earnings by Election Day 2025. Call it, The Election-to-Election Bear Market.

Yellen & Brainard: Odds are exceedingly high that the market savvy Treasury Secretary Janet Yellen and NEC Director Lael Brainard engineer a major equity market rally into Election Day 2024 (from lower SPX levels than here, of course); and with the Fed likely on hold at 525-500 and handcuffed by the politics of election season, Yellen and Brainard’s “tools” - over $1 trillion of QE dry powder sitting in the TGA and RRP, and a Treasury buyback program waiting in the wings - will be all the more powerful. To allow for enough time to juice consumer confidence, it’s likely this rally commences sometime in the first half of 2024 from circa SPX 3840-4300. (If SPX doesn’t first correct in 1H24, then there won’t be a major rally into Election Day, as SPX is too fully valued given the macro headwinds in place.)

For market participants the key takeaway from this timeline is that the equity market is likely to be well-supported into Election Day 2024. Once the election is over it should quickly become clear which path Powell is likely to take the economy. If for some reason he puts his legacy in the backseat and embarks on a rate cutting cycle that takes Fed Funds down to 325-350 by the November 2025 FOMC meeting, then the Election to Election Bear market is likely off the table. Otherwise, a recessionary bear market decline alongside a breakout in YoY initial jobless claims above 20% is likely in 2025. SPX likely bottoms circa Election Day 2025 in a range of 2000-3000, or 10-15x earnings as recessionary bear market suggests.

First Half 2024

Near-Term Rally

The direction of equities into 1H24 depends on the interaction of long-term UST yields, the direction of US economic data, and investor positioning. Right now the equity market is in the sweet spot with the economy cooling just enough to bring long-term interest rates down, but not enough to breach key recessionary tripwires (such as PMIs < 50, YoY initial claims > 20%) - and critically, investor positioning is not yet a threat to this “Goldilocks” rally.

As discussed by flows expert Cem Karsan on November 16, the nature of flows in a strongly positive year for equities is such that at minimum SPX should be expected to be well-supported into early 2024, if not continue up to perhaps the prior peak of 4819. If and when SPX reaches the 4700-4900 range, by that time investor positioning will very likely become a material threat to the Goldilocks rally.

FED Threat Neutralized

In the very near-term, the number one threat to the Goldilocks rally is the Fed. If the Fed deems the recent loosening of financial conditions as materially detrimental to its war on inflation, then they will come out and aggressively pushback against the move up in stocks and bonds. However, key to assessing the path of FED rhetoric is the TIPS break-evens curve. Like clockwork, when break-evens start moving higher the Fed gets aggressive, and vice versa. Right now it’s “vice versa”. Break-evens have moved sharply lower across the curve with the critical 5y5y tenor back within the Fed’s comfort zone.

Growth Scare Likely

The October 15 WOTE Report made the case that the US economy was likely to enter a material recession in the first half of 20248, defined as YoY initial jobless claims breaking out above 20%. But in light of the material easing of financial conditions (FCI) since late October and the subsequent soft landing fever that’s spread through the economy as a result, given the economy’s hypersensitivity to changes in FCI9 and the fact YoY initial claims is below 5% and heading lower10 it is difficult to see YoY initial claims breaking out above 20% before 2H24. However, not all is well here…

As illustrated below by the great work of Eric Basmajian (EPB Research), timing of the 10y-3M UST curve inversion and the direction of travel of aggregate employment indices suggests the US economy is likely to slow in 1H24.

Yes, financial conditions have eased and the economy is hypersensitive, but A) there is a lag to the impact of easier FCI and B) the economy is much deeper into the “long and variable lags” part of the Fed’s tightening cycle than it was in 2022 and early 2023 when it responded quickly to changes in FCI.

Far and away the biggest threat to the thesis that the economy will stay supported into late 2024 is the possibility the Fed has already cracked the economy, as perhaps suggested by default rates ticking up. Combined with the fact a sizeable corporate refinancing wave is set to kick off in 2024, it is likely economic data prints in 1H24 come close enough to recessionary tripwires to prompt a “growth scare” sell-off in equities.

With market participants fully positioned for Goldilocks in early 2024 and SPX circa 4800, the set-up is there for SPX to sell off 10-20% down to 3840-4300.

ODDS & ENDS

That’s enough digital ink for now. Some things to ponder that will be explored in greater detail in future reports and write-ups:

What is the Fed’s reaction function if the US economy does have a hard landing ahead of the 2024 election?

How do long-term UST rates react to a hard landing in either 2024 or 2025? Will the fiscal response be such that long rates actually rise in a recession?

As discussed in the December 2020 SPX outlook, is the combination of a Tech boom and 5-10% deficit spending enough to power 5-10% nominal growth over the next decade, rendering “tight” FED policy and equity market “overvaluation” irrelevant?

How high do long-term UST rates go in a “no landing” scenario in 2024?

Assuming the US government is still running 5-10% fiscal deficits going into 2026, is a dovish FED Chair replacement even bullish for stocks? In other words, does the bond market really start to move lower on the prospect of loose monetary policy and 5-10% fiscal deficits?

Note 1: Defined as the 10-year UST yield - YoY CPI. I calculate this as of the end of the last month of reported inflation, which in this case is October 31.

Note 2: The long-term average has ticked down from 2.02% as of last November now that another year is included in the average.

The long-term average has ticked down from 91 bps as of last November now that another year is included in the average.

June 30, 2023 LTM Sales and EPS: 1821.35 and 208.1

June 30, 2022 LTM Sales and EPS: 1663.36 and 204.98

November 28, 2022 SPX Close: 3963.94

November 24, 2023 SPX Close: 4559.34

This is admittedly an unscientific way to measure the economy’s sensitivity to changes in FCI, but having lived and breathed markets and economic data over the last two years, the return of animal spirits is palpable once the market deems the Fed to have moved to a friendlier stance and you can see it in real time data reports such as PMI soon after FCI moves up or down for a sustained multi-week/month period.