WOTE Asset Management: June 25, 2024

Updates to current views and positioning, and a continued discussion about rebuilding portfolio management confidence.

Disclaimer: For informational purposes only.

Please see here for more information about The Weight of the Evidence.

Current Views

Business Cycle

June 25, 2024

No change to the May 22 thesis.

June 3, 2024. No change to the May 22 thesis.

May 22, 2024. With the 4-week moving average of US initial jobless claims far from the critical +20% YoY level that would suggest a recessionary bear market decline of at least -35% in the S&P 500 is odds on over the next 1-2 years, the US economy continues to act as a durable floor beneath corporate profits and equity prices. The one caveat, and it’s a big one, is that a strong US economy also puts a floor under inflation. Further, with the fiscal authorities running an unprecedented peacetime deficit of 5-10% of GDP with the economy at full employment, and now commodity prices breaking out across the board, risks are very high that inflation has entered the dreaded “second wave”. How the Fed responds to this second wave will be key to the outlook for the business cycle as we get closer to 2025.

SPX Outlook

June 25, 2024

No change. All dips to SPY 20/50dma are to be bought aggressively from now until Election Day.

June 3, 2024. No real change to the May 22 thesis, but this weekend I reviewed the thesis via X (see here).

May 22, 2024. April’s correction in asset prices provided a critical window into FEDeral government policymakers’ election year mindset. I posited in the March WOTE Report that policymakers would not allow SPX to correct more than -2.54% at any point peak-to-trough, which obviously proved incorrect in April with SPX falling more than -6%. But I do not believe I was as far off as it appears. I believe the Israel-Iran conflict temporarily removed policymakers’ ability to control markets, but it didn’t take long for them to regain control: 1) Yellen sold a “put” in a very clandestine manner, coordinating with foreign central banks to devalue the US Dollar; 2) the Fed dovishly surprised markets by tapering QT more than expected; 3) despite the appearance of a hawkish projected TGA level, Yellen managed to ramp equities in a straight line in May with a $200+ billion TGA QE program in the wake of the April liquidity drain via tax payments; and 4) as soon as the April CPI report showed a modest tick down in YoY Core PCE inflation, the Fed went soft, communicating through Timiraos that a September cut is on the table. Long story short, the FEDeral Government Put is out in full force, and SPX is headed to 6000 in a straight line. As discussed this weekend, SPX is even more compelling on the long side at 5300 today than it was in March because policymakers have shown their hand.

Tactical Risk Management

June 25, 2024

A very weak June 12 CPI report upended the cautious tactical call on June 3, allowing SPX to continue moving vertically to over 5500. But as discussed on X, even in high-velocity, liquidity-driven bull markets such as 2021, SPX will tactically cool off to its 20/50dmas, and I believe the current set-up is such that SPY will pull back to at least its 20dma, if not the 50dma. Yellen is being extremely aggressive in her quest to quash any all bouts of volatility - just yesterday coming out in response to SPX volatility, which no doubt underwrote today’s snap-back - so SPY may only get to its 20dma, currently around $537, perhaps even through a sideways consolidation that allows the 20dma to catch up with SPY between $540 and $545. The 50dma would be a gift. Regardless, I’m not chasing the market here - I’m sitting in neutral and allowing SPY to come to me any way it chooses. Bitcoin continues to plumb the lows of April/May, and IG CDX is sticky, so there is a reasonable chance SPY makes a quick trip down to the 50dma - but I’m not holding my breath, and will play it where it lies.

June 3, 2024. The market provided an excellent buying opportunity last week, precisely in line with the analysis conducted on May 22, that I took advantage of with SPX at its 20dma to establish an overweight position in equities. However, with NFP coming this Friday, and CPI/FOMC next week, this is not a rally to be chased. The Fed is looking to push cuts out to later this year, early next year, so they will view this equity market strength (engineered by them in a clandestine manner, as discussed via X) as a vehicle for delivering that message via the June 12 SEP and Powell press conference. My hunch is that another excellent, high probability buying opportunity will emerge around June 12 somewhere circa SPX 20/50dma, at which point I will move to a maximally overweight equity position.

May 22, 2024. From a tactical risk management perspective, I do not want to be all-in long here after this big run up. Not until SPX returns to key moving averages through time or price. Just this week BTC was unable to hold its breakout, rates have proven sticky, IG CDX is sticky, and VOL is starting to firm up. I don’t believe these divergences are good for more than a quick 1-2% spike down in stocks, but they warrant caution here in the very near-term.

Fixed Income, Currencies, Commodities (FICC)

June 25, 2024

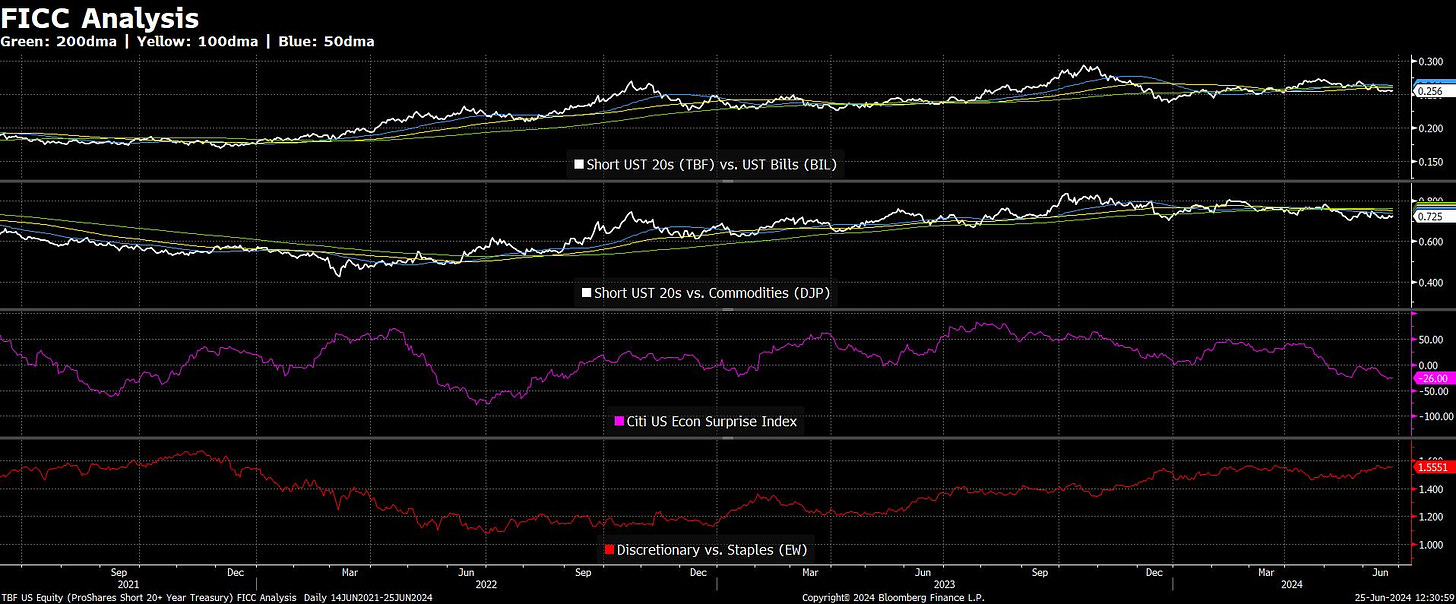

FICC is at an interesting juncture here. The best rates trader I know is long the entire UST curve right now on the thesis that the unemployment rate is going to rise for non-recessionary reasons in the coming months leading the Fed to cut rates starting in September. But I’m currently max short the long-end of the UST curve. This is an uncomfortable place to be because I do not like fading great traders. The problem is my own work on the economy and FICC points quite emphatically toward another push up in rates.

The Citi US Economic Surprise index is currently on the lows. Of course, it could continue moving lower if the US economy has entered a self-sustained soft path, let alone an employment-led downturn that would bring YoY initial claims up to that critical 15-20% level. But the critical Discretionary vs. Staples macro pair is moving higher, rather decisively; and just this morning Canadian inflation data surprised to the upside across the board. As such, I continue to like a heavy buy & hold short position in UST 20s.

My hunch is the Bitcoin weakness and IG CDX stickiness discussed in the Tactical Risk Management section above are pointing toward a reacceleration of US economic data that drags the long end of the UST curve higher. Further, if the Fed continues to stay dovishly on hold even with YoY core PCE moving up to 2.8% by the end of this year, I think that dynamic only exacerbates the ultimate move up in long-term rates as the bond market challenges the Fed’s inflation-fighting resolve.

So, how do I square the long UST curve positioning of my rate trader friend and my max bearish position? I think it’s a matter of time horizon. He’s very likely correct in the short-term and we get another spike lower in rates; but then rates ultimately reverse higher into EOY on a reacceleration of economic activity and inflation.

As far as shorting UST 20s versus owning commodities, I continue to prefer the bond short, as any rallying in commodities is self-defeating since it would lead directly to higher long-term bond yields.

June 3, 2024. No change to the May 22 thesis.

May 22, 2024. Strongly favor being short the long end of the UST curve over owning commodities, since a breakout in commodities will be inherently self-defeating as a result of higher long-term rates and/or more aggressive FED action in response to rising inflation. See the latest WOTE Quant report for more discussion and analysis on this.

Positioning

June 25, 2024

WOTE US 60/40: Currently sitting at a neutral benchmark weight of 60/40 SPLG/BIL, as updated on June 20.

WOTE US Long/Short Equity: Currently sitting at a neutral benchmark weight of 100% SPLG, as updated on June 20.

WOTE US Core Equity: 42% RSP, 58% XLI as of June 14.

WOTE US Core FICC: -200% short UST 20s via the TBT ETF as of June 18.

June 3, 2024

WOTE US 60/40: 70/30 SPLG/BIL

WOTE US Long/Short Equity: 200% long via SSO ETF

WOTE US Core Equity: Benchmark weight 100% SPLG (no change)

WOTE US Core FICC: -100% short UST 20s via the TBF ETF (no change)

May 22, 2024

WOTE US 60/40: Benchmark weight 60/40 SPLG/BIL

WOTE US Long/Short Equity: Benchmark weight 100% SPLG

WOTE US Core Equity: Benchmark weight 100% SPLG

WOTE US Core FICC: -100% short UST 20s via the TBF ETF

Discussion

Confidence Continues to Build: June 25, 2024

Building on the discussion below from June 3, the rebuilding of my portfolio management confidence continues. On May 30 I moved my 60/40 and Long/Short strategies into an overweight equity position within 24 hours of the low of the pullback into May 31; and then on June 20 I reduced exposure in both strategies down to a neutral benchmark weight at almost the exact high.

These precise moves were no accident. They were the direct result of moving to a “neutral benchmark-centric” portfolio management framework that allows me to sit, wait, watch and stalk while I let the market come to me with my mind free from the distraction of managing poor entry/exit points. Of course, I’m never going to consistently time tops and bottoms. But the entire point of my “weight of the evidence” approach to markets is to allow evidence to build to the point of overwhelming “weight”, which more often than not will allow me to act within a zone of a key top/bottom.

Also boosting confidence over the last month is the complete and total transformation of my WOTE Special Ops strategy. I’ve taken just ONE trade since May 31, and a tiny one at that. Otherwise, I’ve been in cash this entire month sitting, waiting, watching, and stalking, letting the market come to me. For someone who was dramatically over-trading and rudderless, this is a MASSIVE, MASSIVE confidence boost. I have one person, who shall remain nameless for the time being, to thank for this transformation. By merely listening to me the weekend of May 31, at the depths of trading despair, he pulled me up. I cannot thank him enough, and I believe I will ultimately owe the rest of my career to him, as he allowed me to begin to develop the ability to let the market come to me, an ability, when fully developed, he calls a “super power”. I am far from mastering this ability, but the last month is one heckuva a good start.

Rebuilding Confidence: June 3, 2024

As discussed in the May 22 WAM Home Page update, I recently made a handful of critical changes to my process, the most important of which is a shift to a more flexible portfolio construction process centered on a default position of a neutral benchmark weight until extremes emerge within the context of my core SPX market outlook. Last week was a small, yet critical step in the right direction of rebuilding confidence in my portfolio management. Despite my resolute bullish outlook for stocks into Election Day, I judged the very near-term tactical outlook as cautious and stayed at a neutral benchmark weight in my 60/40 and Long/Short strategies while I waited for SPX to meet its 20/50dmas. Once the 20dma was met last week, I moved into an OW position while leaving room to add more on further weakness perhaps around the June 12 CPI/FOMC day, as discussed above in the Current Views & Positioning section. So far so good. Now that I have established a solid entry point into the OW equity position, I can confidently wait, watch, and stalk the next opportunity: either to reduce positioning back to neutral on a major squeeze, or to increase the OW on a retest of the 20/50dma circa June 12.

Strategies

These are my five US-centric personal investment strategies.

WOTE US 60/40

Benchmark: 60% SPY, 40% BIL

Discussion: The WOTE US 60/40 strategy is designed to isolate my performance over- and under-weighting equities versus fixed income in the context of a US 60/40 portfolio.

WOTE US Core Equity

Benchmark: SPY

Discussion: The WOTE US Core Equity strategy is designed to isolate my performance in equity sector selection in a fully invested US equity portfolio with a SPY benchmark. This portfolio would typically comprise the equity portion of the WOTE US 60/40 portfolio, but for performance reporting purposes I want to break the investment process into its component parts.

WOTE US Long/Short Equity

Benchmark: SPY

Discussion: I do not short individual equities, so the vast majority of the short exposure in this strategy is to indices and sectors, but primarily the key indices SPX and NDX. When 200-300% long exposure is warranted, the strategy can be aggressively long select sector ETFs and individual securities.

Benchmark: SPY

Discussion: Highly aggressive, options-based strategy.

WOTE US Core FICC

Benchmark: BIL

Discussion: Go-anywhere strategy within USD-based FICC markets.

Performance

See prior discussion here.

Disclaimer

NOT FINANCIAL ADVICE

The Weight of the Evidence (The WOTE) newsletter (inclusive of anything and everything publicly and privately associated with it, no matter how tangential) contains the author’s own thoughts and opinions on financial markets. The WOTE is for educational and entertainment purposes only and none of the content or ideas should be taken as financial advice. The author is not responsible for any financial gain or loss that you may incur by acting on the information provided. You are solely responsible for making your own investment decisions and should do your own due diligence in regard to opinions and ideas on the markets to form your own personal view and form your own trades. For investment or financial advice, consult with a registered investment advisor and/or financial advisor. By reading The WOTE you are agreeing to these terms, and acknowledge it is for sharing the author’s thoughts and opinions on financial markets. Your trading and investing style, preferences, and risk management may significantly differ from the author’s.