The Fed: Soft Landing Dynamic. Hard Landing Outlook

Soft Landing Dynamic

Core CPI peaked at 6.6% YoY in September 2022 and has since fallen to 4.8% as of June 2023, a 1.8pp decline in 9 months. Over that time, the unemployment rate is basically flat at 3.6% as of the June reading versus 3.5% last September. This is exceedingly abnormal “inflation vs. labor” behavior going back to 1968. Because inflation is typically a lagging indicator, historically the inflation peak arrives inside of recession with the unemployment rate up more than 50% on average from its cycle trough.

This abnormality in the “inflation vs. labor” relationship has led to another abnormality: the direction of the real Fed Funds Rate (FFR) (defined as the effective FFR - YoY Core CPI). Historically, as YoY Core CPI peaks alongside a rising unemployment rate, the Federal Reserve is cutting rates to protect the labor market; and by the time YoY Core CPI falls 1.8pp from its peak, the real FFR is -1.4% and falling. Today, the real FFR is .3% and rising.

This is a soft landing dynamic through and through. If you’re FED Chair Jerome Powell you are ecstatic that you just got the real FFR a hair into positive territory with an upward trajectory at this point in the disinflation process. The labor side of the Fed’s dual mandate has yet to knock him off course, and from here he can allow disinflation to tighten the stance of policy while he waits for the unemployment rate to rise enough to bring wage inflation back to 3-3.5% (currently running at 4-5% depending on the measure).

But that’s all it is: a dynamic. The outlook is for a hard landing because the Fed is fighting the ghost of Arthur Burns.

Hard Landing Outlook

The Ghost of Arthur Burns

The ghost of Arthur Burns is a series of higher lows in YoY Core CPI, AND the unemployment rate (not many people talk about this), as a result of “stop and go” monetary policy.

This relationship between high and (perhaps most importantly) volatile inflation and the labor market is precisely why Chair Powell’s opening paragraph at each press conference states:

“Without price stability, the economy doesn’t work for anyone. In particular, without price stability we will not achieve a sustained period of strong labor market conditions that benefit all.”

Higher for Longer

Since last July1, the Powell Fed has been very explicit in its intention to avoid the “stop and go” policy error of the Burns Fed. They do not want to cut interest rates and allow inflation to reemerge in the next economic upswing, and now that they’re homing in on the terminal rate we’re starting to get more explicit guidance around phase three of the tightening program. Phase 1 was about the speed of hikes; phase 2, currently underway, aims to reach a “sufficiently restrictive” stance of policy; and once the terminal rate is reached, phase 3 entails debate about how long to hold at the terminal rate.

At last week’s post-FOMC meeting press conference Victoria Guida tried to pin Powell down on what it would take for the Fed to cut rates, asking: “So, if it’s sort of stubbornly in the high twos, you wouldn’t necessarily cute rates?” Powell’s answer provided the most explicit rate cut guidance to-date, albeit wrapped in his typical dovish musings:

“I’m not saying that at all. I’m not giving you any numerical guidance around that. I’m saying…we’d be comfortable cutting rates when we’re comfortable cutting rates, and that won’t be this year I don’t think…many people wrote down rate cuts for next year…I think the median was for several for next year. And that’s just going to be a judgment that we have to make then, a full year from now and it’ll be about how confident we are that inflation is in fact coming down to our 2 percent goal.”

On one hand Powell appears very open to cutting rates with inflation in the “high twos” and even cutting rates this calendar year - those are the dovish musings. Then he states very explicitly that the judgment about rate cuts will come “a full year from now.” He did not need to say that. He could have kept it to “And that’s just going to be a judgment that we have to make then” (meaning next year).

The June SEP projects Core PCE inflation to be 3.9% YoY in 4Q23 and 2.6% YoY in 4Q24 alongside an unemployment rate of 4.1% and 4.6%, respectively.

That means Powell explicitly guided to not cutting rates until YoY Core PCE inflation is somewhere between 2.6% and 3.9% and the unemployment rate between 4.1% and 4.6%. That’s a hard landing outcome from a historical perspective, and very much risks a crash landing.

(Before moving on to the next section, for reference the latest quarterly YoY Core PCE reading that just printed for June 30 came in at 4.4% versus the 4.1% YoY figure for the month of June. Small but important difference to keep in mind when interpreting data through the lens of the SEP.)

The Landing

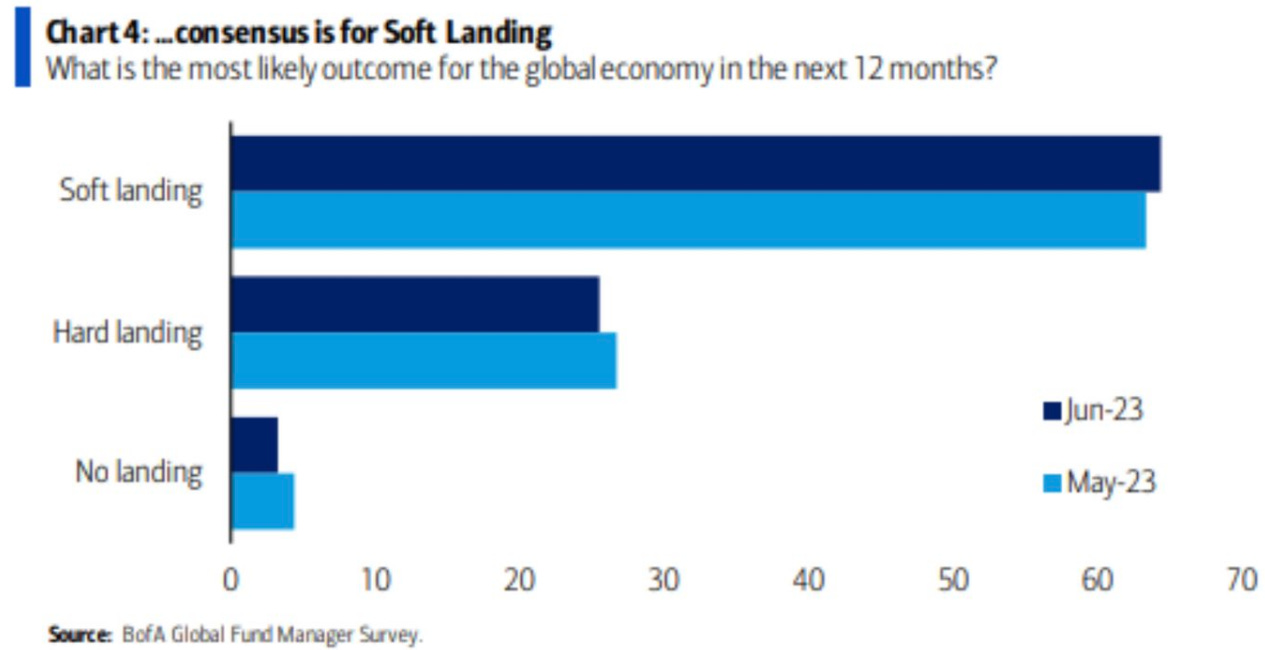

The June SEP projects the unemployment rate rising to 4.1-4.5%, a 70 bps rise from the cycle low of 3.4% at the mid-point of the projection. Since 1955, just once has the UR risen by at least 70 bps and the US economy not gone into recession: 1959 (by mid-1960 the economy was in recession). All other rises in the UR have been associated with recession, which is why the consensus base case outlook for a soft landing defies logic with a FED explicitly guiding to no rate cuts until the UR rises.

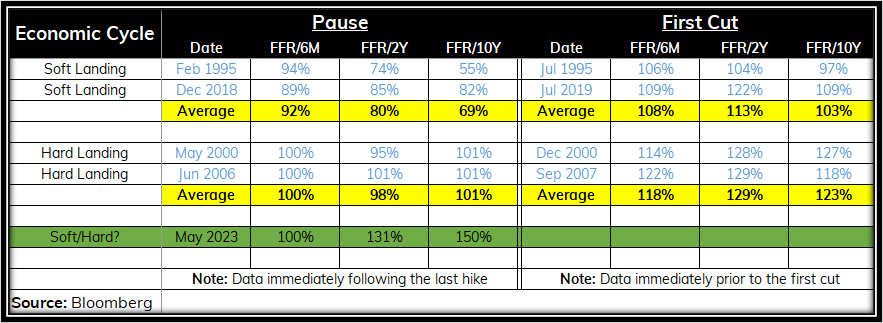

To close, updating the FFR cycle analysis discussed in May2, if July was the final hike of the cycle the bond market is saying the Fed is well past the point of being able to avoid recession even if it wanted to.

But updating the pre-recession analysis discussed in June3, while the YoY changes in NFP and nominal Final Sales are well within the pre-recession range seen in the Great Inflation period, the “YoY change in Final Sales - Fed Funds” shows monetary policy isn’t quite tight enough from a historical perspective for a recession to be underway just yet. Admittedly, this is a new metric I just started toying around with this weekend (h/t to Eric Basmajian for the concept), but it tends to align with the prospect of a recession hitting sometime in 4Q23.