The Cyclical CASP: December 4, 2023

Bullish quantitative evidence rapidly accumulating on the back of FED Chair Powell d/b/a Arthur Burns. On watch for an SPX parabola into January, ala January 2018 and June 2020.

Discussion

The Cyclical CASP forms the quantitative cyclical outlook for SPX - the topic of this report - while the qualitative cyclical outlook is developed via zooming out and processing the direction and interaction of FED policy, the economy, and interest rates. Before diving into the quantitative, a quick word on the qualitative cyclical outlook.

As discussed at length in the SPX Market Outlook, the qualitative cyclical outlook for the next 1-12 months is a tale of three parts: a near-term Goldilocks rally on falling rates and still-strong economic data into early 2024, a growth scare in 1H24, and a Treasury-engineered rally into Election Day 2024. At first blush the qualitative outlook is neutral instead of the current “bearish” rating I have assigned to it; but in this highly unusual economic and market cycle, nothing moves in a straight line. So, before I upgrade the qualitative cyclical outlook to neutral (it is unlikely to be upgraded to bullish given the highly negative 2025 outlook, but I would need to revisit that bearish 2025 thesis if in fact the Fed pulls a Burns and starts cutting in March), I need to see the market digest the slowdown in economic data likely to hit in the coming weeks/months. It’s against this qualitative cyclical outlook backdrop that the quantitative outlook needs to be digested.

As outlined in detail below, the weight of the quantitative cyclical evidence is quickly shifting into the bullish camp. This is incredibly counterintuitive relative to a decisively bearish structural outlook for the economy and stocks looking out to May 15, 2026 - the end of Jerome Powell’s term as FED Chair - but the data are the data. It’s likely a time frame issue, which is why I like to break the outlook down into its structural (1-2 years), cyclical (1-12 months), and tactical (1-4 weeks) components.

My hunch is that the bullish quantitative data is picking up on a supportive cyclical environment for risk assets in a POTUS election year with two very savvy market operators (Treasury Secretary Janet Yellen and NEC Director Lael Brainard) sitting on over $1 trillion of market-supportive QE stockpiled in the TGA and RRP. This bullish cyclical outlook is likely to be confirmed in the coming days/weeks with a series of powerful breadth thrust signals (some have already fired), but as history suggests these signals more often than not mark a near-term top in equities. The nature of the post-breadth thrust pullback, likely alongside a “scary” deterioration in economic data, will inform an updated qualitative view of the cyclical outlook into year-end 2024.

Executive Summary

Positioning: Bullish. Sentiment and positioning indicators continue to move up alongside equities (bullish), but have yet to reach extreme upside readings (also bullish). A key tell on positioning/sentiment is when indicators peak and begin to roll over alongside higher equity prices. Not there yet.

Breadth Levels: Neutral. The % of SPX stocks above their 50dma is currently circa 86%, a level that has marked near-term market tops since mid-2022; but in high-velocity cyclical advances such as May-June 2022, equities continue powering higher. With seasonally bullish flows in place into January and Powell d/b/a Arthur Burns, the stage is set for a June 2022-like SPX parabola that marks a near-term top in equities. However, decisive bearish divergences in total market 200dma breadth and the NYSE advance/decline line keep the overall breadth level rating as “neutral”.

Breadth Thrusts: Bullish to Very Bullish. 3 out of 7 key thrust signals have fired, with a critical 4th signal on the cusp and a strong likelihood of the bear market killer 50dma thrust signal firing. I’m as structurally bearish as anyone. But these signals cannot be belligerently fought.

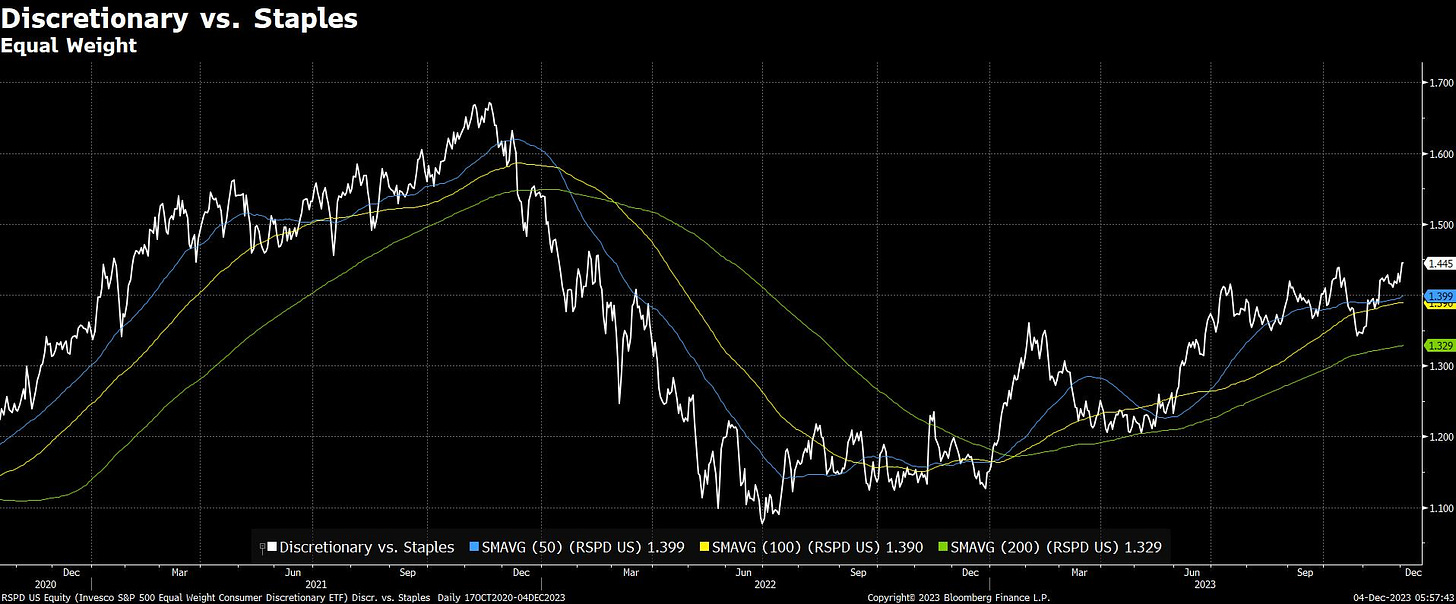

Relative Strength: Unequivocally Bullish. Defensive sectors remain mired in well-defined relative strength downtrends, while key macro relationships (Banks/Utilities, Discretionary/Staples) are breaking out.

Credit: Neutral. Tactically bullish given the speed of the credit spread contraction, but still structurally bearish given the fact spreads remain above 12/31/2021 levels.

Technicals: Bullish. The combination of the fact SPX continues to power through “overbought” conditions with rising moving averages, the heavy weight of bullish quantitative evidence, and Powell d/b/a Arthur Burns strongly suggests this SPX advance will not pause for a 5-10% pullback until SPX 4818.62 is tapped.

Quantitative Cyclical SPX Outlook: Bullish to Quite Bullish

Positioning: Bullish

NAAIM continues to work its way higher but is not yet at the historically extreme levels that would suggest a 5-10% SPX pullback is at hand.

Same goes for the SPX Daily Sentiment Index. Working its way higher, but not yet at the extremes that have historically marked a tactical top in equities.

On the other hand, a more comprehensive medium-term measure of investor sentiment and positioning is really starting to get into extreme upside territory. This is something to watch closely. However, in high-velocity bull market moves (i.e. those associated with a package of strong breadth thrust signals) such as those seen in 2019 and 2020, this measure of sentiment reaching these levels did not impede the equity advance - in fact, it behaved almost as confirmation of the advance.

Breadth Levels: Neutral

At 86% SPY 50dma breadth is almost so good it’s bad, as circa these levels has marked the top of rallies since mid-2022. However…

…In a high-velocity move early in a cyclical bull market advance, these levels of 50dma breadth are healthy. For instance, in May 2020 SPY 50dma breadth hit 80-85% and SPX continued to go vertical into June. SPX did ultimately pullback, but never back to levels where 50dma breadth became “overbought”. Given bullish seasonal flows from now until January, rapidly hardening expectations of FED rate cuts in 1H24, and FED Chair Powell’s very obvious Burns-like current status, I am on close watch for a June 2022-like SPX parabola into January.

Offsetting some of the bullish excitement around 50dma breadth dynamics are the bearish divergences in total market 200dma breadth and the NYSE advance/decline line. These bearish divergences are classic late-cycle, last-gasp bull traps ahead of an economic downturn, so they need to be monitored very closely. As such, overall breadth levels continue to be rated “neutral”.

Breadth Thrusts: Bullish to Very Bullish

3 out of 7 key breadth thrust signals have fired (Zweig, deGraaf, and 30-day highs) with a 4th right on the edge: the very important 10-day advance/decline signal. 10dma breadth has yet to fire, as does 10-day advancing/total volume; but given the speed of this advance I strongly suspect the mission critical 50dma thrust signal is on the cusp of firing. 50dma breadth has marked the end of every single bear market since the early 1970s, so it cannot be ignored. Further, once the 50dma breadth thrust signal fired in February 2019 and May 2020, SPX continued higher for a time before correcting. In June 2020 SPX went parabolic into a local top but never corrected back below its 50dma signal level; while in 2019 SPX corrected back to just below the 50dma signal.

Relative Strength: Unequivocally Bullish

Defensive sectors remain in decisive relative strength downtrends, showing only nascent signs of bottoming. I believe these sectors are in the process of bottoming out and should work higher over the course of 2024 in advance of a nasty 2025 macro, BUT, from a quantitative signaling perspective looking out 1-12 months, there is nothing emanating from these sectors to suggest the broad market is materially at risk.

This bullish outlook is confirmed by a breakout in the Banks/Utilities and Discretionary/Staples relationships, key signals for determining the cyclical outlook for stocks and the economy.

Credit: Neutral

The credit dashboard is tactically bullish as a result of key spread measures rapidly moving lower, but still structurally bearish sitting well above the 12/31/2021 levels seen pre-FED tightening. If this dashboard can move below 12/31/2021 levels, a brand new economic and market cycle will very likely be confirmed.

Technicals: Bullish

SPX continues to bullishly power through its “overbought” condition. And while there is obviously very heavy overhead supply in the 4600-4818.62 zone, the weight of the bullish quantitative evidenced combined with Powell d/b/a Arthur Burns strongly suggests this advance will not stop for a 5-10% pullback until the 4818.62 ATH is tapped.

The second chart below shows the January 2018 move up in SPX. Given the possibility the JPM SPX collar pins the market circa 4515 into year-end (how a single fund can pin the entire market is beyond my paygrade), I think there is a decent chance of a flattish December followed by a January 2018-like parabola up to SPX 4818.62 by that January 17 VIXperation date Cem Karsan recently cited as a key potential turning point.