Discussion

The entire WOTE Asset Management concept has been in incubation since late last year, as I wrestle with how best to express the performance of my cross-asset market research work via The WOTE. So far YTD it’s been an incredible DUD from a performance perspective across the suite. Part of it is the incubation process, part of it is a tough market environment, and part of it is me wrestling with how to best marry tactical market management with medium- to long-term positioning and thinking.

The bottom line is this: The cross-asset market outlook generated across The WOTE platform has inhibited me from more aggressively managing my strategies via tactical risk management signals, as I like to think long-term and hold positions through volatility. But no more.

For instance, this weekend I downgraded the cyclical outlook for SPX, which entails a change in positioning. But, if my vast array of risk management signals calls for an adjustment that is counter to that cyclical outlook, I will not hesitate to change well in advance of articulating the thesis.

This weekend will be viewed in hindsight as the weekend The WOTE turned into a Money Printer Go Brrr machine.

WOTE US Long/Short Equity

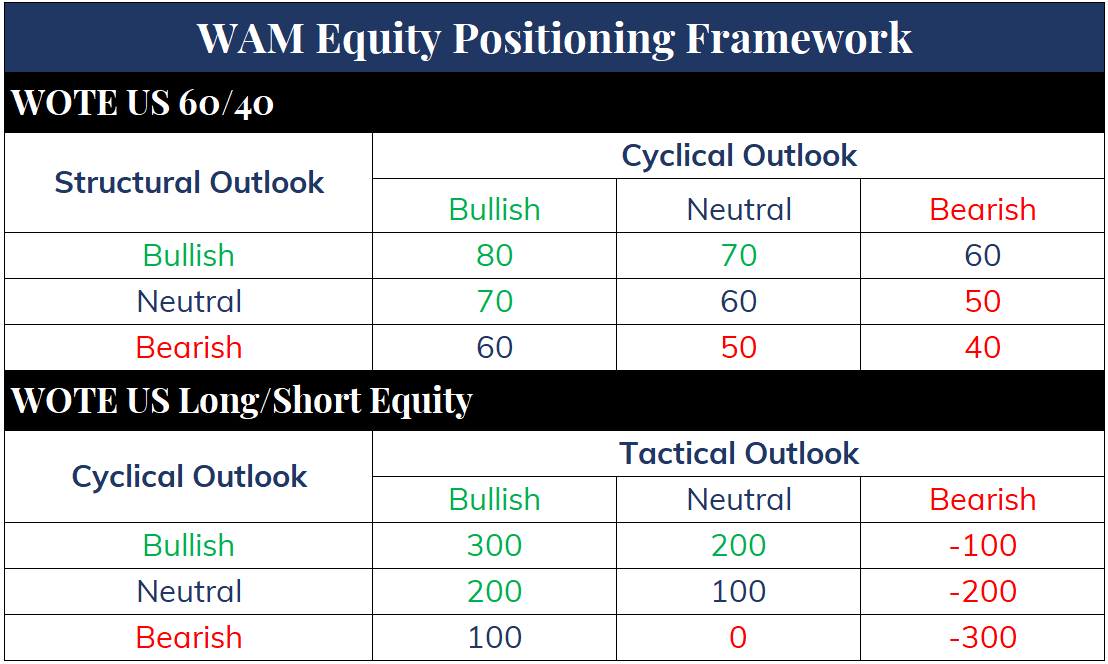

To-date, I have struggled managing the Long/Short strategy taking into account the longer-term structural outlook that drives the 60/40 allocation, and the more tactical near-term risks and opportunities I write about every week on The WOTE. As such, I have adjusted the positioning framework for Long/Short equity exposure to the following:

At present, my cyclical and tactical outlooks are bearish, thus Long/Short is maximally short, as discussed this morning.

WOTE Special Ops

This is a highly aggressive, options-based strategy that I have tried to manage according to a medium-term positioning framework. No more.

Options cannot be bought and held, as is my inclination. They must be aggressively traded according to risk management signals. I have left untold amounts of $$$ on the table by trying to manage this strategy according to a relatively long-term positioning framework. No more.

Further - I have written in the past about a “trader” I follow who has a process that not only complements my own, but acts as a great hedge against my own stupidity. I’ve added another trader to this mix, both of which complement my own process as well as each other. WOTE Special Ops will be managed from here on out via three buckets, 1/3 each:

The WOTE

Trader 1

Trader 2

This strategy will have its own specific channel and chat for logging strategy and trades, as I don’t want to clog up the WAM channel.