WAM Strategy Note: Selling Tech. Buying Industrials

In my WOTE US Core Equity strategy I am moving out of a neutral benchmark weight position and into a broad-based bet against Tech via Industrials (XLI) and equal weight (RSP) exposure.

Disclaimer: For informational purposes only.

Please see here for more information about The Weight of the Evidence.

Portfolio Action

Back on May 2 I took my WOTE US Core Equity strategy to a 100% SPX weight using the SPLG ETF, as I did not see any compelling asymmetric opportunities at the SPX sector level. But now I do.

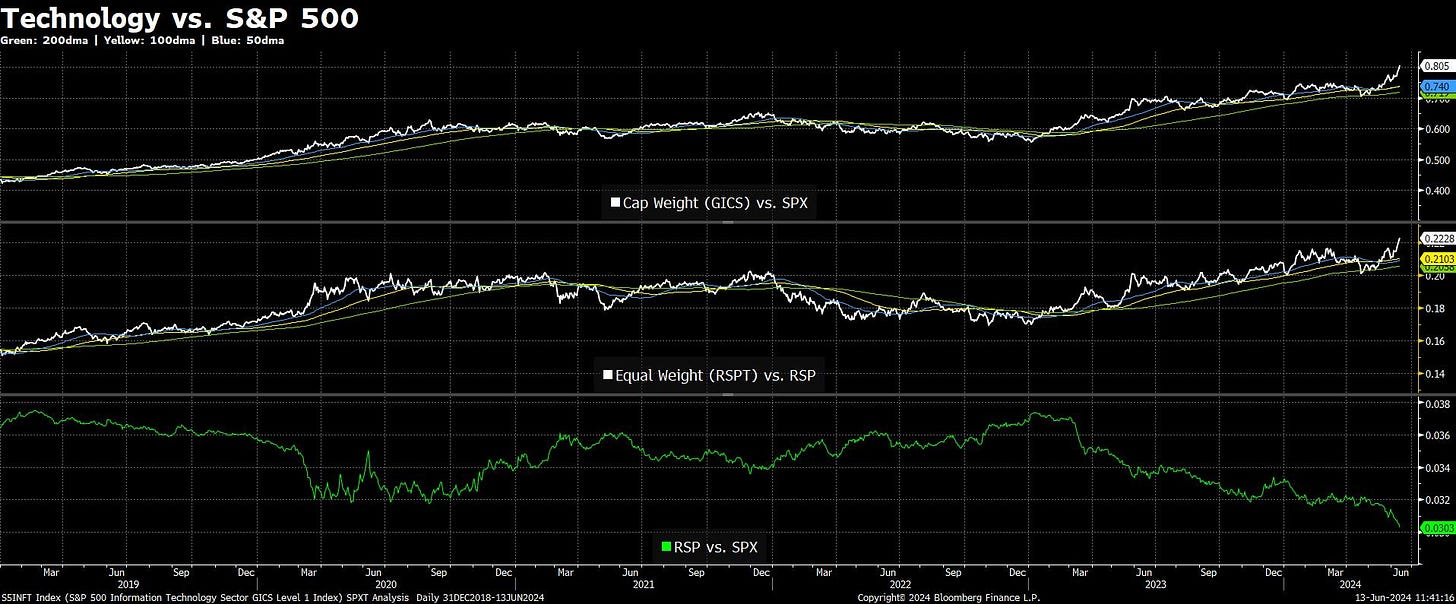

Tech’s big breakout has left all other sectors in its wake, setting up a broad opportunity to bet against Tech on a multi-month basis. The question is what to buy.

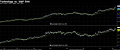

With the key Discretionary versus Staples macro pair moving higher, it appears widespread concern about an economic growth downturn is decisively unfounded. As such, outside of Tech I want to buy cyclicality generally, but Industrials specifically.

So, today I put 33% of the strategy in the Industrials XLI ETF for a ~25% active exposure, and 42% in the RSP equal-weight SPX ETF, leaving 25% in SPLG. I will use that 25% SPLG position as a source of funds to buy more XLI in the event Tech makes one last push higher.

Discussion

The move in Tech generally and Semis specifically is very, very likely in the process of peaking right here and now on a relative basis. As SPX continues higher into 6000 by Election day, Tech and Semis are likely to lag the rest of the market.

The question from here is what do you buy outside of Tech?

If the economy was setting up to roll over, you’d buy defensive sectors. But with a 5-10% fiscal deficit pumping fresh private sector net worth into the economy every day, it’s tough for the economy to roll over; and despite many calls across the market for the imminent start of an economic growth downturn, according to the “guts of the stock market,” as Stan Druckenmiller likes to say, the economy appears to be setting up to reaccelerate (see Discretionary vs. Staples breaking higher below). As such, I want to buy cyclicality instead of defensives.

But not just any cyclical sector - I want to own Industrials. The average Industrial stock is still in a healthy uptrend versus the average S&P 500 stock, which in the past has been a key tell for confidently buying a washed out cap weight relative strength chart.

Financials are breaking down, and with the Fed likely to keep H4L rate policy in place far longer than an eternally dovish consensus believes, Banks are likely to remain under pressure. Energy might be interesting, but I don’t love the series of lower highs and lows.

So, beyond Industrials I just want to own the average stock as a way to bet against Tech.