Discussion

I put this latest outlook piece together via Twitter.

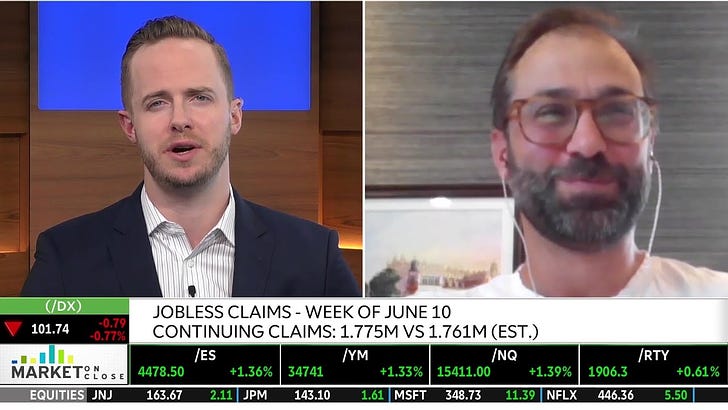

The basis for the outlook was the Cem Karsan interview on June 15, which in The WOTE’s opinion will go down as one of the greatest real-time market calls in history.

What makes Karsan’s call special is the commentary that preceded it over the last year generally, but specifically on May 31 starting at minute 29 of the following video.

Karsan’s focus on the flows emanating from the options market fills a hole in The WOTE’s process, as that level of specificity and expertise just is not available to those outside of the options and volatility world. The “pinning” of the equity market as a result of excess shorts and options selling explains perfectly the disconnect between the very negative fundamental outlook The WOTE has been dialed into since December 2021, and a seemingly resilient S&P 500.

As Karsan outlined on June 15, the SPX has become “unpinned”. He does not provide a downside level or time frame, but The WOTE will: SPX 3000 by October 31, 2023. How the Fed reacts to that level will determine the extent to which further downside is realized.

The WOTE continues to maintain that 1Q24 is a key time frame for the equity market, as the Biden administration will want to stimulate economic activity and financial markets ahead of Election Day. If the Fed halts rate hikes and QT at SPX 3000 sometime in the next 3-4 months, SPX is likely to rally into year-end perhaps as high as back to that October 2022 low of circa 3490. But then ultimately the bear market should resume as the full weight of the Fed’s war on inflation is felt into 1Q24. The WOTE suspects the Fed will begin cutting rates between SPX 2500 and 3000, which should keep the ultimate low at around 2500. However, if the Fed sticks to its anti-Burns reaction function and doesn’t cut rates at SPX 2500, 2000 is easily in play.

But first things first: Let’s reassess at SPX 3000 sometime in October.