The Market: Twitter Channel Evidence of a Major Top

Discussion

On Friday The WOTE said:

“The WOTE takes in as much evidence from as many different sources as possible, including anonymous market participants on “Finance Twitter”. If you follow folks who document their views and trades in real time for long enough, you can get a pretty good sense of their efficacy, and they end up becoming a valuable and regular piece of broad market puzzle.”

Since Friday, a number of key pieces of market evidence have come through The WOTE’s Twitter channel that are worth compiling as an addendum to The WOTE’s Q1 2024 outlook.

First, subsequent to Friday’s write-up it came to The WOTE’s attention that the Twitter user “INArteCarloDoss” (Carlo) highlighted in write-up also happens to have an SPX 2500 target for the ultimate low of this bear market, outlined via Twitter last June (prior to when The WOTE started following his work).

Second and also Carlo related, this morning Carlo called out a thread by user “lawhon_sam”, who is apparently a regular and key contributor to Carlo’s private Twitter research community. The entire thread is worth reading, but the closing conclusions tweet is key, along the lines of The WOTE’s “SPX 4200 first, then 2500” thesis.

Third, and admittedly a bit out there as a result of his eclectic, and at times extreme, style, one of The WOTE’s long-time pieces of Twitter channel evidence is a user by the name of “xtrends”. The WOTE first came across xtrends in January 2020, just prior to the COVID crash hitting, and had the privilege of witnessing via Twitter a large chunk of his analysis in real time over the course of the crash. The precision of analysis and execution was other-worldly. Not perfect - he was a bit wrong-footed in the April-June 2020 time frame when it wasn’t entirely clear that the SPX would go back and retest its March 23 low - but there is nobody better at trading bear markets, and it’s not even close. And he has hit the ball out of the park yet again so far in this bear. To the detriment of The WOTE’s P&L, The WOTE failed to heed xtrend’s call for a big bear market rally starting in June 2022 and again in January 2023. xtrends is only a piece of evidence within The WOTE’s process, but one could do a lot worse than to blindly follow his analysis.

Yesterday, he outlined his own SPX 2500 target for this bear market using a completely different approach than The WOTE, and noted the “weak breadth” nature of this rally. (As The WOTE discussed Friday, the late 2007 rally to a new all-time high is a good frame of reference for this current rally, and it was the weak breadth in 2007 that was a dead giveaway of its lack of sustainability. It’s nice to have xtrends’ analysis confirm the validity of this late 2007 thesis.)

His SPX 2500 target was the key part of the post, but his comment that the decline will be a “bidless beast” should send chills up the spine of every market participant given that is how he described the COVID crash…ex ante.

Buckle. Up.

Lastly, this morning xtrends hit precisely on the point The WOTE has been making since February, that 2022 was not the real bear market.

This matters because bear markets are often thought of having a “time” component as well as a “price” component. In other words, a bear market that goes down -20% over the course of three years may have the same aggregate effect on market sentiment and structure as a -40% decline over a year and a half. Because this decline has not (yet) been of the -50% magnitude historical evidence suggests it should be, many have leaned on the “time” component to justify the possibility that October 2022 was THE low for this bear market. This places bullish market participants in a very offsides position, because if in fact this bear market is just getting going, as The WOTE detailed on a March 14 Twitter space (see starting at and around minute 9 of the video below), there is far more “time” and “price” left to go than virtually anyone appreciates.

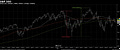

To close, it’s worth homing in on the chart embedded in xtrends’ post this morning showing the 2-Year US Treasury Note yield minus the 6-Month Bill yield versus the S&P 500 (first chart below). It’s formatted differently than The WOTE’s chart from Friday (second chart below), but the message is precisely the same: a deeply inverted 6M to 2Y curve is extraordinarily bearish for equities, as it is the economy’s way of waving the white flag to the Fed. On its own this is bearish, let alone with a Fed laser-focused on not repeating the “stop and go” monetary policy error of the Burns Fed in the 1970s.

Let’s hope the bear stops mauling portfolios at SPX 2500.