The Market: Risk-Off Window Continues to Open

Powell next week is a key catalyst in either direction depending on how SPX trades into FOMC.

Discussion

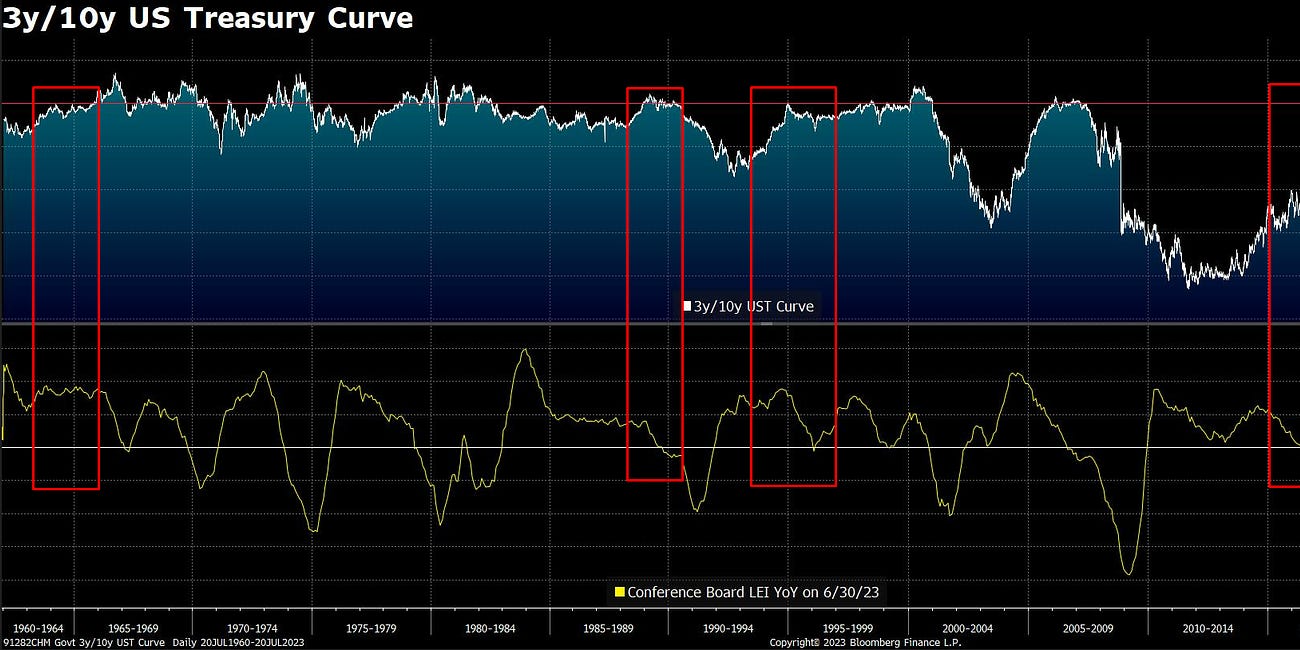

I’ll continue to reiterate: Until 90% of stocks move above their 50dma and the 3y/10y UST curve moves out of inversion, SPX market history says to look down not up.

Market sentiment and positioning have blown out to the upside, as market participants capitulate to the “soft landing” view that a new economic (and in turn earnings) upswing is upon us. This shift in sentiment has occurred just as the US economy homes in on a “hard landing” commencing sometime in 4Q23.

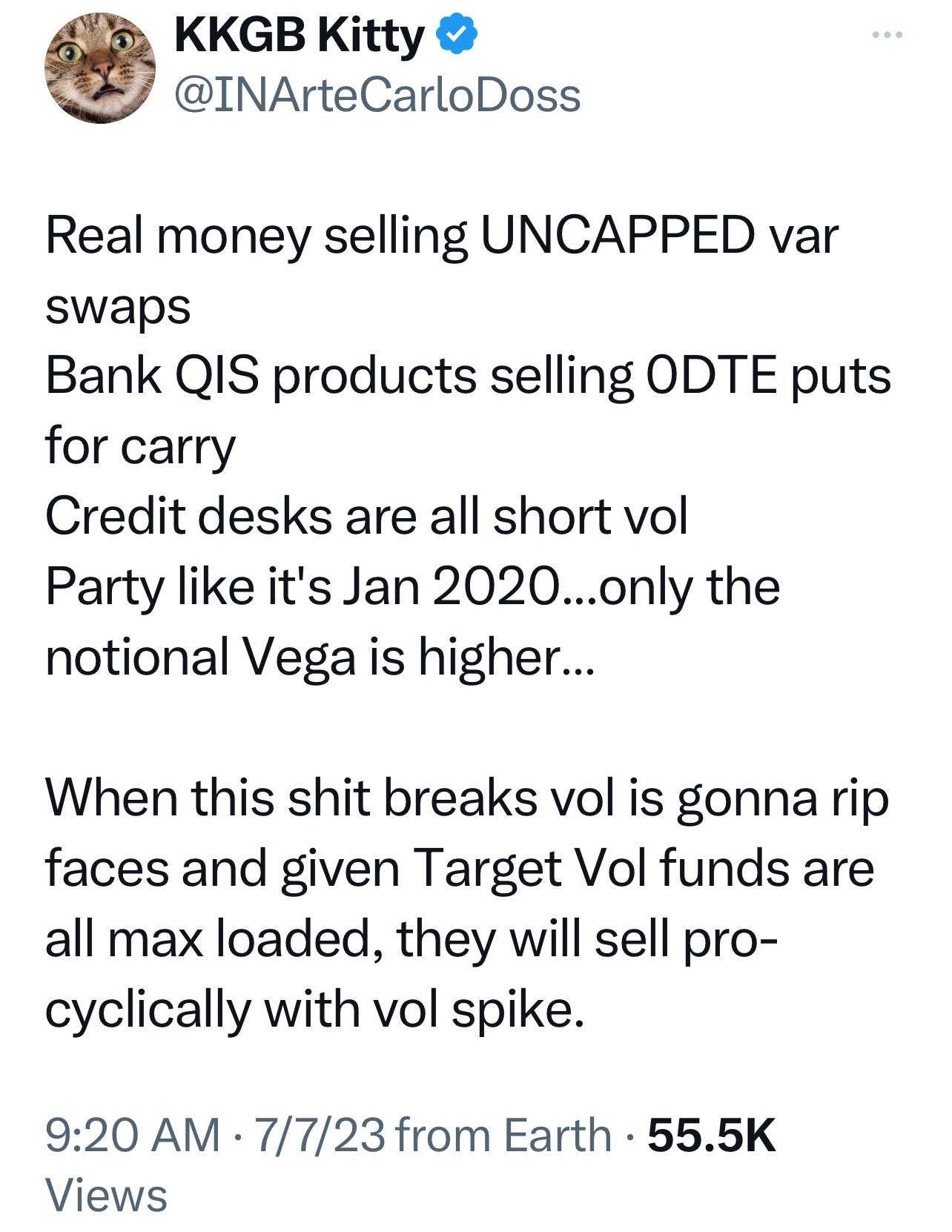

With July OPEX out of the way, equities will be less “pinned” by dealer positioning and thus able to move more freely in response to fundamental developments, and ultimately punish irresponsible VOL selling.

How SPX trades into Powell on July 26 will determine his press conference message and tone. If SPX sells off, he will be overtly dovish, citing the “disinflationary process underway,” the “widening path to a soft landing,” and perhaps even hinting at early 2024 rate cuts. A short-term oversold SPX + an overtly dovish Powell would very likely underwrite an explosive blow-off move to 4600/4700 in relatively short order. (My thought has been that we could see 4818.62 in the final squeeze, but today’s large cap Tech price action in response to earnings takes that off the table, IMO.) From there, the descent into September/October should commence. On the other hand, if SPX drifts higher into Powell, leading him to feel comfortable that financial stability is not an immediate concern, then he is likely to reiterate Waller’s July 13 message of September being on the table in the event inflation data don’t continue to improve and the economy doesn’t show signs of sustained slowing. In this scenario SPX probably knee-jerk spikes 4600 in response to the press conference, and then commences with the decline into September/October (perhaps temporarily interrupted by a dovish Powell at Jackson Hole in August).