The Market: It's the Yield Curve, Stupid

The S&P 500 is at a fork in the road: new bull market as indicated by breadth and credit signals, or new bear market lows driven by Fed re-tightening financial conditions. Yield curve says new lows.

Discussion

For the second time since its January 2022 peak (mid-August 2022 being the first) the S&P 500 is at a fork in the bear market road. Fork #1: Breadth is breaking out (commonly referred to as a “breadth thrust”), the cost of credit protection is breaking down, the US Dollar is trending lower, and key cyclical industries and relationships are breaking out, the combination of which has led to a material easing of financial conditions (as measured by the Goldman Sachs US Financial Conditions Index falling below its June 2022 peak). This condition set is almost uniformly bullish from an historical perspective. So, “buy, buy, buy”? Not so fast.

The problem with fork #1, the same problem that existed in mid-August 2022, is this: Before the Federal Reserve allows financial conditions to ease on a sustained basis, it needs to be “highly confident…that easing financial conditions won’t lead to an inflation rebound” - the framework outlined by former NY Fed President Bill Dudley on July 14, 2022 (more on this in a bit). The Fed hinted at this “highly confident” framework in the minutes of the December 2022 FOMC meeting when it said:

“Participants noted that, because monetary policy worked importantly through financial markets, an unwarranted easing in financial conditions, especially if driven by a misperception by the public of the Committee's reaction function, would complicate the Committee's effort to restore price stability.”

To maintain “plausible deniability” for policy flexibility purposes, the Fed likes to speak in code. For instance, when Chair Powell said at Jackson Hole that “some pain” would be necessary to bring inflation back to 2%, he was vague enough to leave open the possibility of a “soft landing”, even though keen Fed watchers know full well that “some pain” means recession. “Unwarranted” is the latest code word du jour.

Based on the aggressive easing of financial conditions since mid-December, it is clear that financial market participants have concluded that the recent deceleration in Atlanta Fed Wages and Average Hourly Earnings are data points that “warrant” an easing of financial conditions.

But here’s the problem: As prophesied by Bill Dudley on July 14, 2022 (see below), reiterated by Mary Daly on January 9, 2023 (see here), and confirmed by the “economic machine” experts at Bridgewater on January 6, 2023 (see here), the Fed must drive the unemployment rate up to a level that ensures enough labor market slack is in place to keep realized inflation well-anchored around 2% once the Fed lets financials conditions ease for good. Here’s Dudley:

“…the Fed needs to be confident that it has succeeded in pushing inflation back down on a sustainable basis. Chair Powell correctly understands that the costs of not hitting the 2% target over the next year or two outweigh the costs of a mild recession – because failure would cause inflation expectations to rise, necessitating an even tighter monetary policy and a deeper downturn later. In the late 1960s and the 1970s, the central bank tightened monetary policy enough to push inflation lower at times, but it reversed course too soon. As a result, the peaks and the troughs for inflation kept moving higher — until the 1980s, when Paul Volcker had to force a deep recession to regain control. Given this history, officials will be hesitant to stop tightening until they’re highly confident (probability greater than 80%) that they’ve done enough — that the labor market has sufficient slack to keep inflation low and stable, and that easing financial conditions won’t lead to a inflation rebound.”

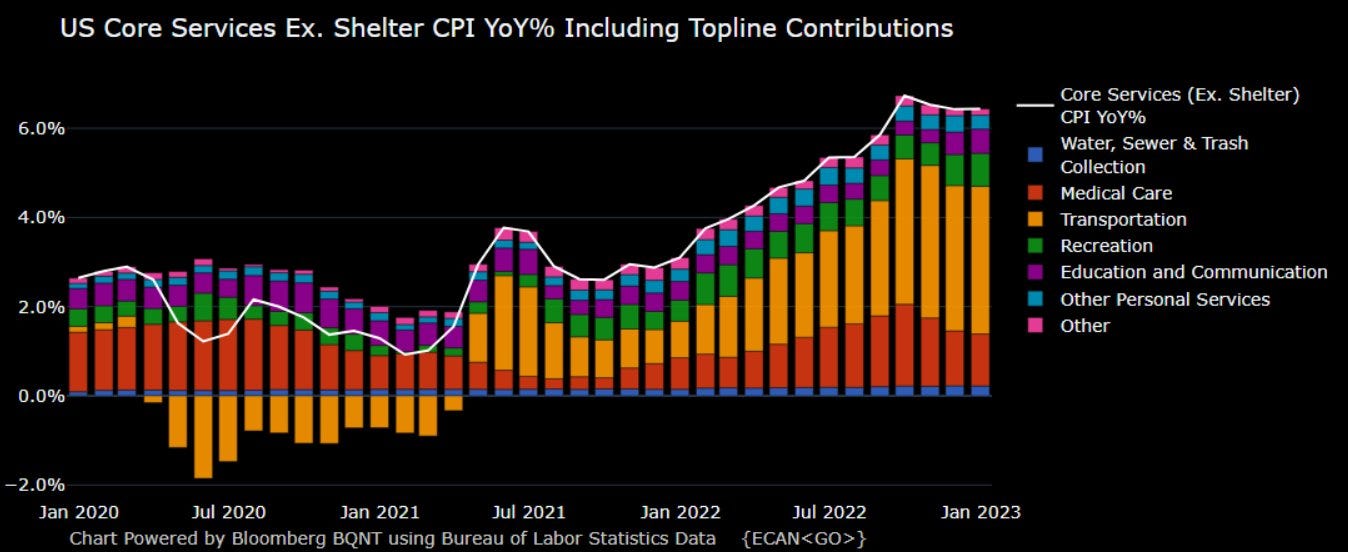

With Core Services ex. Housing inflation running at 6% YoY and the unemployment rate 1.1% below the Fed’s year-end 2023 target of 4.6%, the conditions for a sustained easing of financial conditions do not appear to be in place. As such, fork #2 is the Fed taking aggressive action to (yet again) re-tighten financial conditions, which would likely entail credit spreads moving to new highs and the S&P 500 falling to new lows. So, “sell, sell, sell”? Not so fast.

The problem with fork #2 is it requires the Fed to take action, which is always difficult to handicap. So, we need a tiebreaker.

Enter: The Yield Curve

At the four S&P 500 bear market troughs in the Great Inflation period (May 1970, October 1974, March 1980, August 1982), the 3y/10y UST curve was 99%, 102%, 110%, and 97% (102% on average). As illustrated by the white boxes in the image below, the 3y/10y curve moved decisively below 100% as the SPX rallied out of each trough, indicating a bullish easing of monetary policy was firmly at the market’s back.

By comparison, at the S&P 500’s bear market low in October 2022 the 3y/10y curve was 111%, well above the 102% average in the Great Inflation period. And while the case could be made that 111% is in line with March 1980 reading of 110%, the curve has behaved nothing like it did alongside the SPX rally coming out of the March 1980 bottom when it dropped to 100% within a month and 90% within two. Since October 2022 the 3y/10y curve never moved lower than 106%, and in fact went on to make a new high of 117% in early December before dropping back to its current 111% reading.

Conclusion: The yield curve breaks the tie. Look for the Fed to re-tighten financial conditions and take the S&P 500 down fork #2 to new bear market lows.

Tactical Considerations

How the Fed re-tightens financial conditions is up for debate. In the December 2022 SEP the FOMC penciled in a terminal Fed Funds Rate (FFR) of 5.1%, and since then almost every FOMC speaker has reiterated the Committee’s intent to get the FFR above 5%. Yet not only has the Overnight Indexed Swaps (OIS) market consistently rejected the terminal rate (it got up to 5.04% by June and is currently 4.94%), it continues to price in 2H23 rate cuts, a direct repudiation of the Fed’s stated intention to hold the FFR at its terminal rate into 2024 (with the dovish Bostic even saying “well into 2024”). Something doesn’t add up.

Given the Fed’s borderline obsession with reminding financial markets that it will not repeat the “stop and go” monetary policy error of the Burns Fed in the 1970s, rate cuts immediately following the termination of this hiking cycle would do irreversible damage to the Fed’s 5-10 year credibility. If inflation remains structurally high over the next 5-10 years, the Fed is going to need as much inflation-fighting credibility as possible to maintain well-anchored inflation expectations, so it is mission critical to follow through on its commitment to not to “prematurely ease” monetary policy. As such, the OIS market’s rate cut pricing likely indicates something else is at work.

The Weight of the Evidence (WOTE) Substack thesis is the Fed terminates the hiking cycle after hiking by 25 bps on February 1. A 25 bps hike would bring the FFR up to 4.58%, just 11 bps above the OIS market’s December 2023 estimate of 4.47%.

Ex ante, equity market bulls will view the Fed pausing at 4.58% as bullish. But it’s not. Underlying The WOTE thesis is that the Fed re-tightens financial conditions back to bear market tights, if not tighter (see key lines in the image below), allowing them to back off on rate hikes and let the equity and credit markets do the remaining tightening work on their behalf.

So, how will the Fed re-tighten financial conditions with the OIS market rejecting “higher for longer”? The WOTE thesis is they will provide more specific guidance around the unemployment rate, something along the lines of “we will not cut rates unless the unemployment rate moves above 6%.” Why 6%? Because that’s the figure Minneapolis Fed President Neel Kashkari used in a recent NYT interview as a point of reference for when the Fed’s tightening program could become “tricky.”

But those are simply tactical considerations. The critical bottom line for equity market participants is that the yield curve does not confirm the bullish outlook emanating from breadth and credit indicators.

It’s the yield curve, stupid.