The Market: Downturn in the Data Confirmed

Discussion

Economic data have started to turn down sooner than The WOTE anticipated in the March 31 Outlook. Today, the ISM Services report revealed a sharp deceleration in the service side of the economy in March, coming in at 51.2 versus the consensus forecast of 54.4. On March 31 The WOTE flagged ISM Services as a key indicator to watch for the equity market to wake up to the fact a severe recession is very much a non-zero probability, so while 51.2 is not yet below the 50 line that separates contraction from expansion, the combination of a downside surprise in the data and a sharp move lower in bond yields says a persistent and pervasive downturn in the data has begun.

The Overnight Indexed Swaps (OIS) market this morning now has the Fed Funds Rate below 400 bps by December, a full three rate cuts from current levels. FRB Cleveland President Loretta Mester just this morning told Bloomberg that she is open to rate cuts only if the data evolve differently than her baseline forecast of 4.5% unemployment and 3.75% YoY inflation by year-end. At present, the TIPS market projects 1-year ahead headline CPI inflation to be 3% - it is highly unlikely the Fed’s dashboard of even stickier underlying measures of core inflation will be below 3% on a YoY basis by the end of 2023. As such, it remains The WOTE’s thesis that the bond market is flagging a severe recession starting soon (if it’s not here already) that takes the unemployment rate well above the Fed’s 4.5% target by year-end.

Lastly, further confirmation that a severe recession is upon us is the fact the 6M T-Bill/2Y T-Note yield ratio has blown out to 128%, a historically nasty signal for the economy and stock market when concurrent with a downturn in leading economic indicators such as the Conference Board LEI or the suite of indicators from the Economic Cycle Research Institute (see their latest economic commentary here).

Exhibits

Downside surprise in ISM Services indicates the bulk of the US economy is decelerating sharply (not just the manufacturing sector).

OIS now has the FFR below 400 by year-end, a full three rate cuts from current levels.

TIPS break-evens have inflation at 3% YoY over the next 12 months.

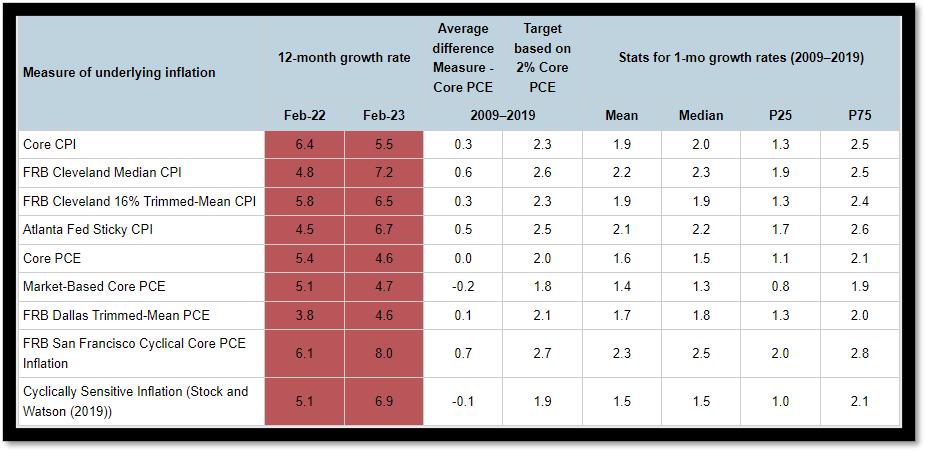

Highly unlikely the Fed’s dashboard of underlying inflation is at 3% YoY by year-end.

6M/2Y ratio indicates a severe recession is in train (if not here already). Look for the unemployment rate to rise above the Fed’s 4.5% target by year-end.

March FOMC Summary of Economic Projections calls for a 5.1% FFR with a 4.5% unemployment rate and YoY 4Q23 PCE inflation of 3.3% by year-end. Either need lower inflation (unlikely) or higher unemployment for the Fed to consider a lower FFR.

Lastly, and FWIW, The Carter (The WOTE’s Twitter handle) spoke about the outlook for the economy and equities at length in a Twitter space last night (circa minute 4 through 21).