Discussion

This weekend I wrote about how the 2-year US Treasury note yield’s behavior heading into the July 2022 and February 2023 FOMC meetings was a key tell that FED Chair Powell was likely to be dovish. Using those two meetings as a template, my thesis for this week’s press conference was that if 2s started falling early this week that was likely a sign that Powell would lean dovish, perhaps by openly and glowingly cheering the prospect of a soft landing and all but declaring victory over inflation as so many market participants have done on his behalf in the wake of the last CPI report.

Outside of a rather hawkish title and subtitle, to me this morning’s Nick Timiraos FOMC preview read as “decidedly neutral”, but former FED Vice Chair Roger Ferguson’s interview this morning on CNBC helped break the tie.

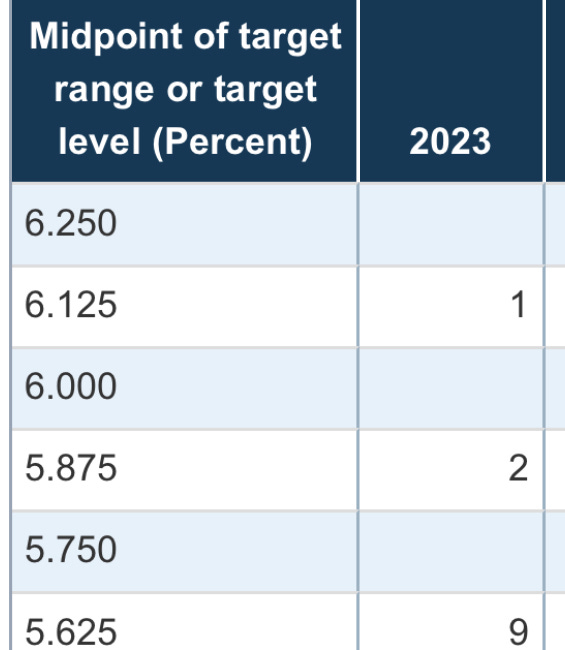

The key takeaway from the Ferguson interview is that Powell is likely to communicate that both the September and November FOMC meetings are “live”. In other words, if the data don’t cooperate the Fed very well could hike another 50 bps to a lower bound of 575 by November. Putting ALL the pieces together, going back to the July 6 “Hard Landing” Fed Watch piece below recall that Julian Brigden said his policy contacts have communicated to him that the Fed is hesitant to hike beyond July because they fear another 25 in September could cement a hard landing, which underscores how big of a deal it is for Powell to open the door to two more hikes beyond July.

I do not expect Powell to be as hawkish as he was at the November and December 2022 FOMC press conferences, let alone Jackson Hole 2022, but relative to a market frothing at the mouth for him to endorse the “widening” path to a soft landing and all but declare victory over inflation, the weight of the communication evidence from Timiraos and Ferguson, combined with the price action in 2s, tells me he will be quite hawkish. Definitely more hawkish than even I thought was likely just two weeks ago.

The bottom line is that even if the Fed is actually “going for” a soft landing, it cannot actually go for a soft landing because the resultant easing of financial conditions undermines their ability to actually go for a soft landing. Tortured logic, yes, but that’s the reality of trying to engineer a soft landing when a soft landing is not mathematically possible in a high inflation economy driven by excess demand.

We Need to Talk About 2s

The Fed can communicate whatever it wants through official and non-official channels, but what really matters is how financial markets are behaving vis-a-vis FED communication, and right now 2s are acting as if they want to break to new highs. I don’t know when they will, if at all, but despite a soft Core CPI print on July 12 and a raft of weak economic data since (as recently as this morning’s PMI data), 2s are almost back to 500, currently trading at 490 as I type at 2:54pm EST on July 24.

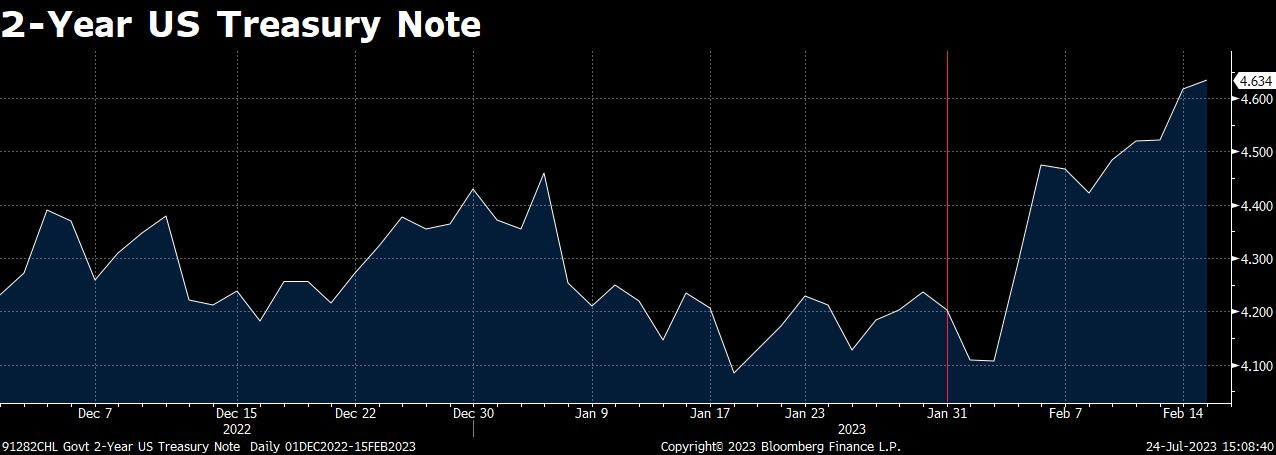

2s’ behavior heading into this FOMC is very dissimilar to how they traded heading into Powell’s very dovish July 27, 2022 and February 1, 2023 post-FOMC press conferences. This tells me at minimum Powell will be neutral with a hawkish lean, but more likely it doesn’t matter what he says and the bond market will read and react as if it’s hawkish - because the fact of the matter is a truly data-dependent FED IS hawkish, because that means they will respond with even more rate hikes to a resilient economy with sticky above-2% inflation, which means the economy will ultimately contract even more than it otherwise would, which means the recessionary bear market in equities will be that much worse than it otherwise would. (Who knows how equities will respond in immediate response to Powell’s press conference, but what matters by a factor of 100 to me is whether the Fed stays the course on its quest to return inflation to 2%. The second they given up on bringing inflation back to 2%, my thesis that it’s a matter of when not if SPX is staring down a recessionary bear market decline to 2000-3000 must be thrown out the window.)

Heading into the dovish July 27, 2022 Powell presser, 2s closed the night before down 37 bps from their local peak (vertical red line).

Ahead of the February 1, 2023 presser 2s closed -26 bps off the local peak.

But as I type at 2:54pm EST on July 24, 2s are down less than -10 bps from their local peak.

My message is getting old, especially for those who have made gobs of $$$ since the SPX low last October, but until the evidence changes I will continue to reiterate: FED Cometh.