The Fed: Watch Waller

"PCE inflation of 2 percent is our goal, but that goal cannot be achieved for just a moment in time."

Discussion

FED Governor Christopher Waller speaks directly on behalf of Chair Powell, so his January 16 speech and Q&A at Brookings ahead of the Fed’s pre-January 30/31 FOMC meeting blackout period were critical pieces of monetary policy guidance. It is clear from not only Waller’s commentary but subsequent commentary from former FED Vice Chair Roger Ferguson and FRB San Francisco President Mary Daly as well that Waller was sent out with one very specific message: financial market rate cut pricing is inappropriate from the standpoint of both start date (March) and extent of cuts (more than five 25 bps cuts in 2024).

For sure, there were seemingly dovish components of his appearance. He made it clear *he* (aka Powell) is confident inflation is on a path to 2% and that the Fed is in a position to defend the labor market if needed. And perhaps most dovishly he said that financial conditions are sufficiently restrictive despite the aggressive easing of conditions since October. But everything is relative.

Relative to the fact three key macro pairs - Transports vs. Utilities, Discretionary vs. Staples, and Banks vs. Utilities - are breaking out alongside the TIPS break-evens curve, and that the OIS market continues to price more than five rate cuts in 2024, the pre-blackout package of FED commentary was very hawkish. With equities breaking out to new ATHs and the bond market seemingly stable, financial market participants are inappropriately sanguine about the direction of FED policy, setting markets up for a volatile Q1 in response to a hawkish Powell on January 31.

Exhibits

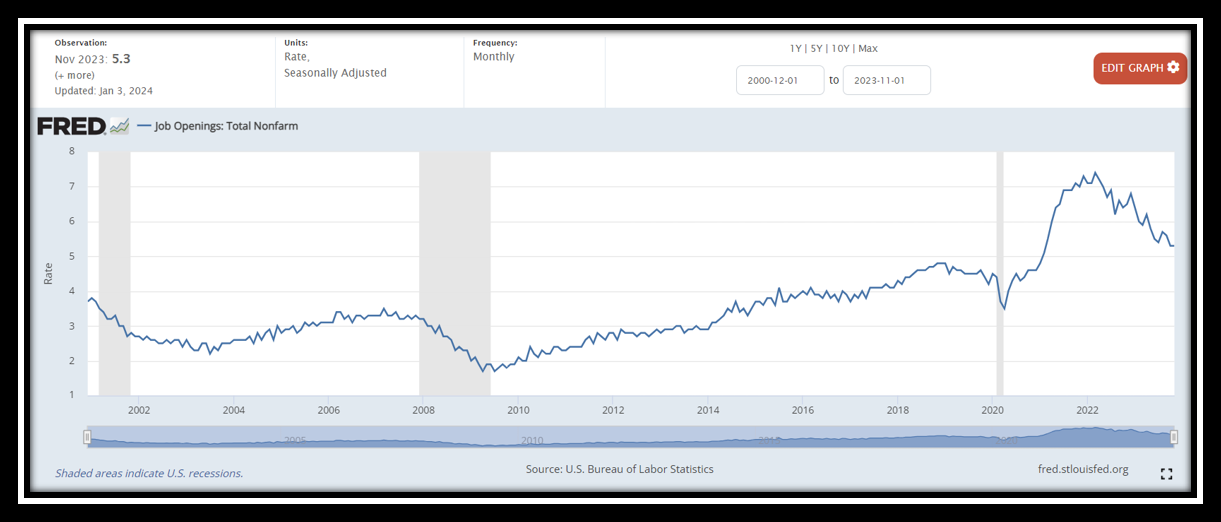

As of January 22 the OIS market continues to price more than five 25 bps rate cuts in 2024 starting in March.

But with three key macro pairs breaking out alongside…

…the critically important TIPS break-evens curve, it is clear that economic activity and inflation are biased to the upside in coming months.

Waller Executive Summary

Detailed notes and quotes are below this executive summary section.

The most important quote from Waller’s speech is the subtitle of this post: “PCE inflation of 2 percent is our goal, but that goal cannot be achieved for just a moment in time.” As long as the labor market hangs in - which a reacceleration of the economy as implied by the three macro pairs discussed above seems to suggest - Waller makes it clear the Fed will wait until inflation is back to the 2% target for more than a year (June 30, 2024) before it begins to normalize rates. That’s a very big deal from the perspective of a market priced for at least five cuts this year.

In the Q&A Waller confirms the above by stating “The worst case is everything reverses and we’ve already started to cut.” Paired with the fact he later says this inflation episode is principally demand-driven, it is our thesis that the Fed will not end up cutting at all in 2024.

Lastly on the hawkish guidance front, Waller ended his speech with: “But I will end by repeating that the timing and number of rate cuts will be driven by the incoming data.” Going out of his way to end the speech with this line is very specific and intentional messaging by the Fed, and the fact the OIS market continues to price cuts starting in March despite a breakout in TIPS break-evens tells us that Powell will be “surprisingly” hawkish on January 31.

And finally, in the Q&A Waller gave very specific guidance around QT, saying the program would likely end with the Fed’s balance sheet at 10-11% of GDP. We go through the math in detail in the Q&A section below, but holding the TGA constant at today’s current $750 billion level, assuming the Fed halts UST QT once the RRP reaches $0, continues MBS QT at $15 billion/month for all of 2025, and the economy grows 7% in 2024 and 5% in 2025, bank reserves would end 2025 at 10.4% of GDP, right at the target Waller guided to. As such, look for UST QT to end sometime this year once the RRP reaches $0 but for the Fed to continue MBS QT “indefinitely” (due to the fact Waller said he does not want to hold MBS on the Fed’s balance sheet).

Waller Speech Notes

Recent data allow the Fed to consider cutting rates

“The data we have received the last few months is allowing the Committee to consider cutting the policy rate in 2024. However, concerns about the sustainability of these data trends requires changes in the path of policy to be carefully calibrated and not rushed. In the end, I am feeling more confident that the economy can continue along its current trajectory.”

4.5% vacancy rate is a gateway to higher unemployment

“We showed in our research that if the vacancy rate continued to fall below 4.5 percent there would be a significant increase in the unemployment rate. So, from now on, the setting of policy needs to proceed with more caution to avoid over-tightening.”

Financial conditions are as tight as they were in July and therefore restrictive enough to continue putting downward pressure on demand

“Recall that the 10-year Treasury yield peaked in mid-October around 5 percent at the time of the jump up in measured economic activity in the third quarter and shortly after a strong jobs report for September. At that point, FOMC participants still expected another rate hike in 2023. But then the data started cooling off, the FOMC's December Summary of Economic Projections indicated no more hikes, and the 10-year Treasury yield fell to around 4 percent, which is roughly where it was just after the FOMC's last rate hike in July. Remember that in July the widespread view was that financial conditions were pretty tight. I consider this to still be true today, and that judgment is supported by current readings of financial conditions indexes, which capture a broader set of financial variables.”

“PCE inflation of 2 percent is our goal, but that goal cannot be achieved for just a moment in time.”

“Data on inflation for December was released last week for the consumer price index (CPI) and producer price index. CPI inflation for both total and core rose 0.3 percent for the month. Producer price index (PPI) inflation numbers reported a continued decline in those prices. Some of the PPI data feed into December PCE inflation, and private sector forecasts suggest that the monthly core PCE reading will be 0.2 percent. If those forecasts hold true, then core PCE inflation in December will remain close to 2 percent, when measured on a 3-month or 6-month basis.

“PCE inflation of 2 percent is our goal, but that goal cannot be achieved for just a moment in time. It must be sustained at a level of 2 percent. As I said earlier, based on economic activity and the cooling of the labor market, I am becoming more confident that we are within striking distance of achieving a sustainable level of 2 percent PCE inflation. I think we are close, but I will need more information in the coming months confirming or (conceivably) challenging the notion that inflation is moving down sustainably toward our inflation goal.”

Three 25bps cuts in 2024 is base case, but timing and extent of cuts will be data-dependent

“As long as inflation doesn't rebound and stay elevated, I believe the FOMC will be able to lower the target range for the federal funds rate this year. This view is consistent with the FOMC's economic projections in December, in which the median projection was three 25-basis-point cuts in 2024. Clearly, the timing of cuts and the actual number of cuts in 2024 will depend on the incoming data. Risks that would delay or dampen my expectation for cuts this year are that economic activity that seems to have moderated in the fourth quarter of 2023 does not play out; that the balance of supply and demand in the labor market, which improved over 2023, stops improving or reverses; and that the gains on moderating inflation evaporate.”

“But I will end by repeating that the timing and number of rate cuts will be driven by the incoming data.”

Waller Q&A Notes

Paraphrasing key quotes due to lack of a transcript.

“The worst case is everything reverses and we’ve already started to cut. We need to see more evidence that this disinflation trend is intact. We believe it is, but we need to see it in the data before we start making decisions.” (21:15)

“I would not want to start cutting until we are relatively convinced inflation is sustainably near our 2% target. When we think we’re there and it will stay there, then we can start saying ‘ok, it’s time to cut’ and then we can start thinking about how fast we want to cut.” (23:20)

“One of the concerns we have is that the drop in inflation over the last six months is principally due to supply chain factors. Those are the kinds of things we want to be careful of before making the first rate cut.” (25:53)

“Bank reserves at 10-11% of GDP is a reasonable target. Once the RRP starts draining and we can start looking at reserves, we’ll start slowing down and looking at these numbers.” (28:15)

Bank reserves + RRP = adjusted reserves = $4,050 billion = 14.7% of 4Q23 GDP

Assuming GDP grows 7% YoY to $29,543 billion in 4Q24, QT is halted once RRP ($647 billion) reaches $0, reserves would close 2024 at 11.5% of GDP

Around 30:15 Waller said he has little interest in holding MBS and would have no issue continuing MBS run-off. If MBS runs off at $15 B/month in 2025 and the economy grows at 5% to $31,020 billion, reserves would close 2025 at $3,223 or 10.4% of GDP, directly in the target range of 10-11%

“If this was a supply shock the price level would have come back down. It hasn’t, which means this is principally a demand-driven issue.” (40:03)