The Fed: "Tighter for Longer"

Discussion

In my framework, a key sentiment “tell” is when market participants who have been on the correct side of a move begin to dismiss data contra to their thesis (mind you, this “tell” applies most powerfully to MYSELF. We all know when it’s time to fade yourself, it’s just very difficult to execute). Back in late 2021, as the major reflation trade that had been in place since mid-2020 was coming to an end as the Fed pivoted aggressively into EOY, the leading reflation bull on the “Street”, Marko Kolanovic, began to explain away the Fed’s hawkish pivot in order to defend his longstanding reflation thesis. I was already in the process of pivoting my thesis and positioning, but his dismissal of the Fed in a December conference call with JPM clients was a key solidifier that I was on the right track. Yesterday I received a similar “tell” from a heretofore soft landing equity bull, and then again this morning from a key FED source.

Prominent FinXwit member “@Banana3Stocks” is a rockstar trader with a great fundamentals + technicals framework. He’s been dead on all year long riding the soft landing bull market, but last night provided a key “tell” along the lines of Kolanovic in December 2021 via a lengthy post mocking the case for structurally elevated inflation.

Is SPX up today in response to CPI? Yes. Was Banana correct on that front? Yes. But zooming out on the broader project of the Fed’s commitment to do whatever it takes to get inflation sustainably back to 2% in a timely manner, his sentiment is a hugely important “tell”. Very simply, soft landing bulls do not believe that inflation is a structural problem that the Fed needs to uproot with very tight monetary policy for a very extended period of time. They still view it as transitory, just as the Fed’s tightening project enters a critical new phase: the “longer” portion of their “higher for longer” framework. I refer to this phase as: “Tighter for Longer”.

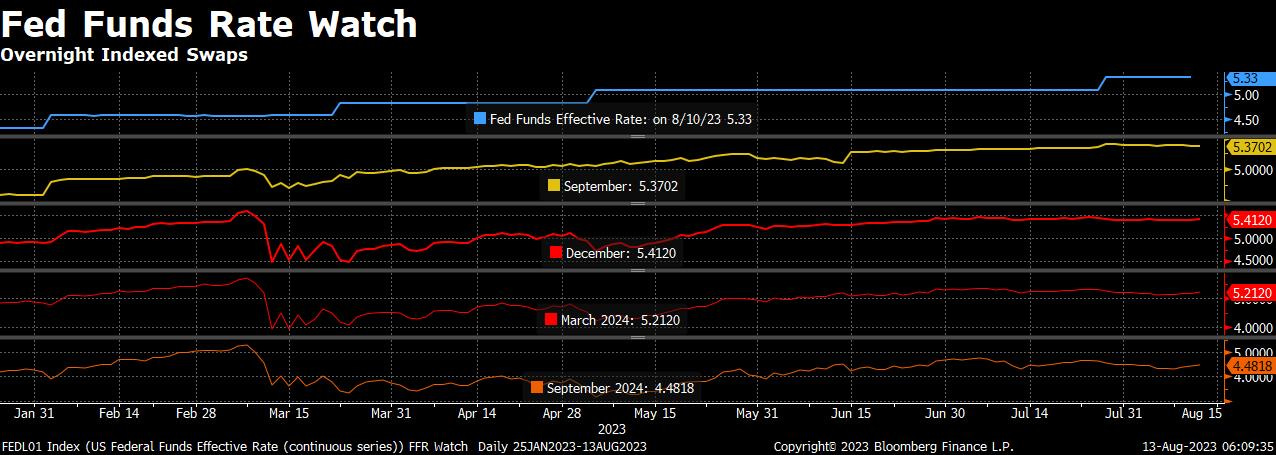

What does “tighter for longer” policy look like exactly? Very simply: Not cutting interest rates until the Fed is “confident” inflation is on its way back to 2% on a sustained basis, which FRB San Francisco President Mary Daly defined very precisely on August 10 as once YoY core nonhousing services inflation is back to pre-pandemic levels. With August CPI data in the books, we now have an updated idea of just how far the Fed is from its “confident” goal (they’re focused on PCE inflation, so CPI is an incomplete picture):

Eyeballing the full core nonhousing services PCE timeseries illustrates just how difficult it is to bring this sticky inflation basket back to target (the August update for PCE doesn’t come until October I believe). A recession in the US economy is not just a possibility, it is a NECESSITY if the Fed is true to its word.

Mary Daly

Above I referred to two key “tells”. Banana was the first, my FED contact was the second. Today my FED contact told me that he had not watched Mary Daly’s August 10 interview and that I was off base in my focus on core nonhousing services inflation. I was, and still am, stunned. This speaks DIRECTLY to the edge I have on FED policy by taking a “weight of the evidence approach” to FED watching. It’s an enormously complicated puzzle that requires sifting through many, many puzzle pieces.

My FED contact’s dismissal of Daly as “one of 12 presidents” and “not part of the troika” confirms the edge.

Yes, Daly is not part of the “troika”. But if you study her appearances, you know that she is very intentionally deployed at very key points in the FED policy communication process. Two examples:

Ahead of Jackson Hole 2022 every FED president and their dog was trotted out in the wake of Powell’s dovish whoopsie at the July 2022 FOMC press conference to reiterate “higher for longer”. Kashkari was first up on July 29 via The New York Times. The hawkish barrage continued all week long, but was punctuated by Daly on a Sunday August 7 Face the Nation interview. When the Fed sends someone out on a Sunday, you pay attention.

Last October 21 the Fed soft-pivoted via Nick Timiraos. This pivot was very clearly coordinated with the BOJ in order to weaken the USD, as that morning pre-market UST 10s were spiking alongside a weakening Yen. As soon as the Timiraos column printed everything reversed and never looked back. Just a few hours after Timiraos printed, guess who the Fed sent out: Mary Daly.

Mary Daly was very specifically deployed this August 10 to communicate the Fed is not going to cut rates until YoY core nonhousing services returns to pre-pandemic levels. It’s that simple.

Confirmation of just how focused the Fed is on bringing demand back in line with supply (which the Fed is measuring this via core nonhousing services inflation) came from FRB Cleveland President Loretta Mester last week.

In simple summary: “Tighter for Longer” cometh.

September SEP Preview

What does this mean for next week’s SEP? Two things:

As Andy Constan outlined back on August 20 (see document below), and Loretta Mester confirmed Jackson Hole weekend, 2024 rate cuts are coming out. Not entirely, but at least some in order to underwrite “tighter for longer” market pricing.

As signaled by FRB Atlanta Raphael Bostic on August 31, R* is headed higher, likely to 325 bps, if not 350, up from 250 in the June SEP. (Perhaps not all of the upward adjustment will come next week, but per Bostic that’s where it’s headed.)

Lest market participants believe the Fed is on a glide path here to a soft landing, and perhaps won’t be that harsh in the September SEP, I would point folks to the sustained move higher in TIPS break-evens. Nothing will push the Fed to re-hawk like inflation expectations. Any sign of dovishness will simply accelerate the recent move up until the economy finally cracks.