The Cyclical CASP: November 20, 2023

The quantitative outlook for SPX is bullish on a cyclical (1-12 months) basis.

Discussion

Tightening up the process as we head into year-end, which I’ll detail in more length in future write-ups and reports. I need a more consistent quantitative framework for developing a cyclical equity market outlook (1-12 months) so that the qualitative analysis around the economy and FED policy doesn’t so heavily dominate my positioning.

As with everything in my process and by extension The WOTE, this part of the process (the components and how often I write about it) will continue to evolve, but for now the framework looks as follows:

Executive Summary

Positioning: Bullish to Very Bullish

Breadth Levels: Neutral

Breadth Thrusts: Neutral

Relative Strength: Unequivocally Bullish

Credit: Neutral

Technicals: Bullish

Quantitative Cyclical SPX Outlook: Bullish

The Cyclical CASP

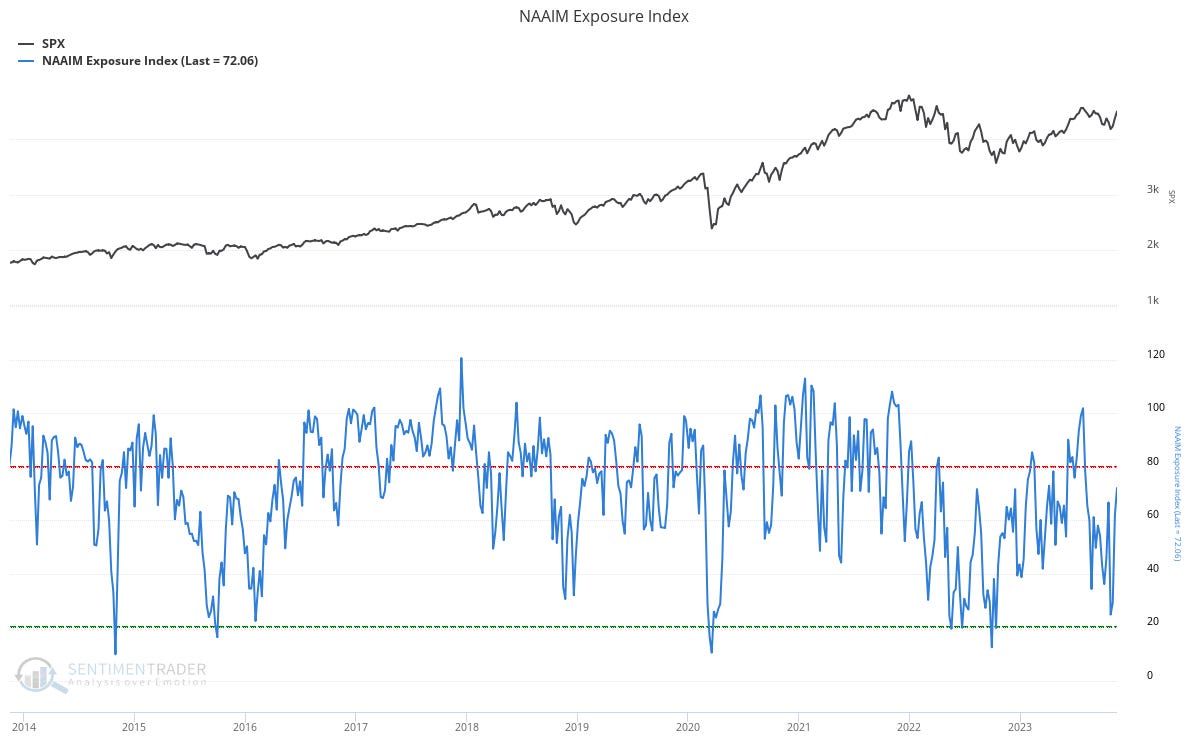

Positioning: Bullish to Very Bullish.

Positioning indicators are in neutral territory, but positioning indicators are most bullish when moving higher out of an oversold condition. Given the strength of the move in equities and the fact positioning indicators have already moved a lot, it’s fair to no longer classify them as “very bullish” - but they are somewhere in between bullish and very bullish.

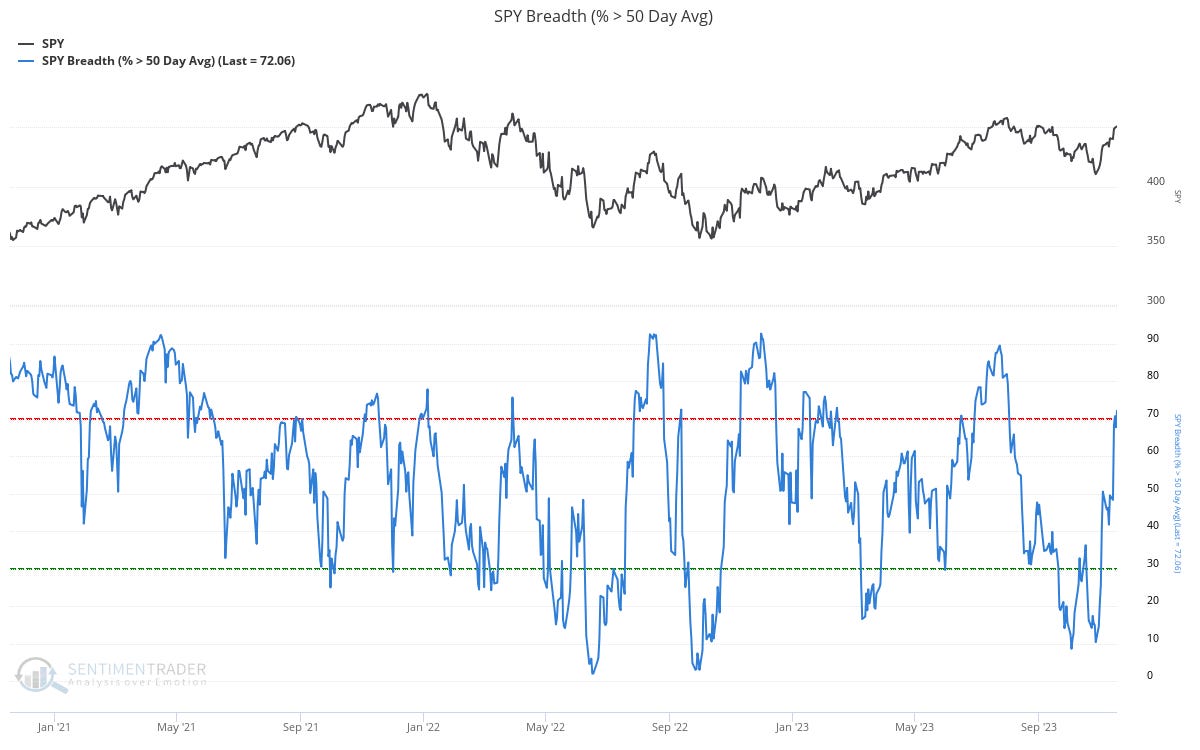

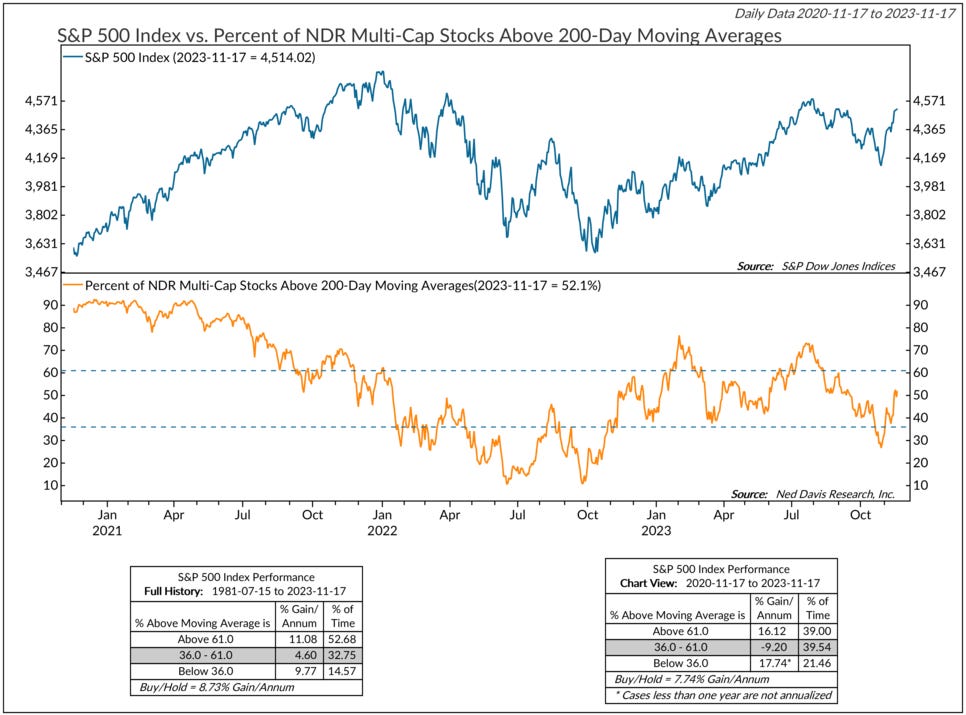

Breadth Levels: Neutral

Breadth levels such as the % of stocks above their 50dma and 200dma are somewhat bullish, moving sharply higher alongside the equity advance. But both 50dma and 200dma breadth in addition to the advance/decline line are exhibiting decisively negative bearish divergences with SPX itself. This happened in May coming out of the SVB crisis, and then breadth ultimately caught up with SPX as the market ripped higher in June and July - given the bullish picture into early 2024 and the tendency for market leaders such as Tech to see strength into EOY, it would not surprise me to see breadth catch up here as it did in June and July.

Breadth Thrusts: Neutral

Thrust signals have been a major pain in the butt for technicals analysts. In hindsight, a handful of key thrust signals fired from June-October 2022, but a variety of thrust signals failed at key local market tops over the course of the 2022 SPX bear leg. Critically, the 50dma thrust signal never confirmed the advance off the October 2022 SPX low (a signal that has officially marked the end of every key bear market low since 1970), which is line with the variety of oddities about this supposed new cyclical bull market since circa SPX 3490.

On this rally off the October 27, 2023 SPX low, only one key thrust signal fired, the Zweig thrust. However, it probably would not take much for others to fire on another 2-3% higher in SPX. But these signals, if they fire, will need to be closely monitored in the broader context of the cyclical and tactical outlook, as timing wise a series of December thrust signals ahead of a likely pre-recessionary equity top in January February could create the set-up for yet another series of failed thrust signals.

Relative Strength: Unequivocally Bullish.

Far and away the most bullish data in support of more equity market rallying. “The guts of the stock market,” as Stan Druckenmiller likes to say, are showing little to no concern about the macro outlook. Given the underperformance of defensive sectors all year long, I strongly suspect this underperformance will continue, if not accelerate, into the January/February 2024 time frame, setting up an excellent buying opportunity ahead of a 2-3Q24 US recession.

Credit: Neutral

The behavior of credit, specifically CDXs, is core to developing a tactical (1-4 weeks) equity market outlook, but for cyclical purposes the broader trends in credit are more important. So, while in the short-term CDXs continue to behave very bullishly - falling sharply every chance they get - overall CDX and spreads levels remain above pre-2021 tightening cycle levels, indicating lingering cyclical concerns about the macro outlook. There is a bit of tactical/cyclical overlap here, so while overall levels are bearish on the macro outlook, the bullish tactical set-up for credit brings the cyclical rating to “neutral” in my framework.

Technicals: Bullish.

SPX is certainly quantitatively overbought in the short-term, but at the surface of the Index its technical profile is bullish with long-term moving averages moving higher and shorter-term moving averages curling back up.