Discussion

VVIX is down sharply at -3% on the day, confirming the SPX/NDX advance, but nothing else does. HY CDX is still up on the day, RSP is red, and most importantly breadth is decisively negative despite green SPX/NDX. At minimum I think SPX and NDX are red again by EOD.

It’s just going to be a chop fest with no breakouts in either direction until we get through Powell, IMO. Rates are too big of a problem. So, I want to be super nimble in both thinking and positioning.

Exhibits

VVIX down on the day is bullish, but it’s not confirmed by a red RSP…

…And green HY CDX.

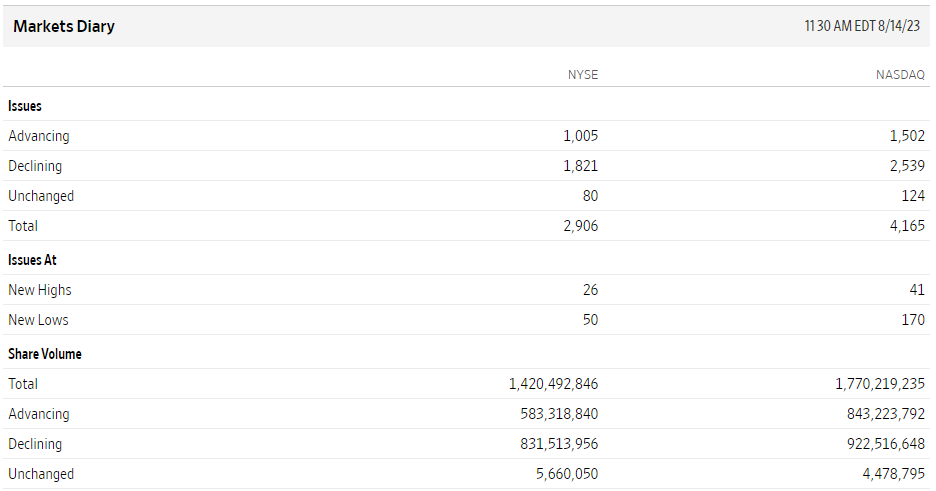

And breadth is sharply negative on the day…

…With the % of stocks above their 50dma negatively diverging with a buoyant SPX.

Rates continue to be an issue, and the fact FFR futures are moving back up confirm. “Higher until highly confident.”