Discussion

Today has all the makings of a key inflection point, one that we may look back on and label “Deflation Day”:

The YoY change in key underlying inflation measures fell materially, and, most importantly, the MoM readings across the board were the lowest of this above-2% inflation cycle.

The UST curve is bull steepening.

The TIPS curve is VERY inverted.

XLU relative strength is beginning to show signs of life, albeit moderate. What’s difficult to pick up looking at the chart in the Exhibits section below is that intra-day XLU shows resurgent strength over the course of the day following weak starts to the trading day. This has occurred now pretty routinely over the last few weeks, even with the UST curve bear steepening - notable.

In a July 9 Fed Watch I said:

“This latest bear steepening has two unique characteristics, at least so far: 1) the Fed is actively “going for” a soft landing, and 2) 10y break-evens are just 227 bps versus the 250-300 bps at the start of the last three bear steepenings. These two characteristics lead me to believe this latest bear steepening is either a fakeout move that is likely to reverse on a softening in Core CPI data over the next two months, or the bond market calling the Fed’s bluff on its ‘soft landing’ attempt.

“How the bond market trades in response to Wednesday’s CPI report will be key in assessing the durability of the move in rates.”

We’ll have to see if this bull steepening move in rates sticks, but the fact XLU is outperforming and key members of my Econonomics “Team” are calling out the durability of the disinflation move tells me the bull steepening move will stick and market sentiment will quickly shift to focusing on underlying weakness in the economy.

The bottom line is that if underlying inflation really is falling as quickly as it now appears, then the economy is far weaker than it appears. High-pressure economies don’t disinflate without a recession. It’s that simple.

Exhibits

Underlying inflation appears to be disinflating quite rapidly.

3y/10y UST curve is bull steepening, historically a sign of economic fragility.

TIPS curve is VERY inverted. Little to no attention is paid to this.

XLU is showing signs of relative strength life.

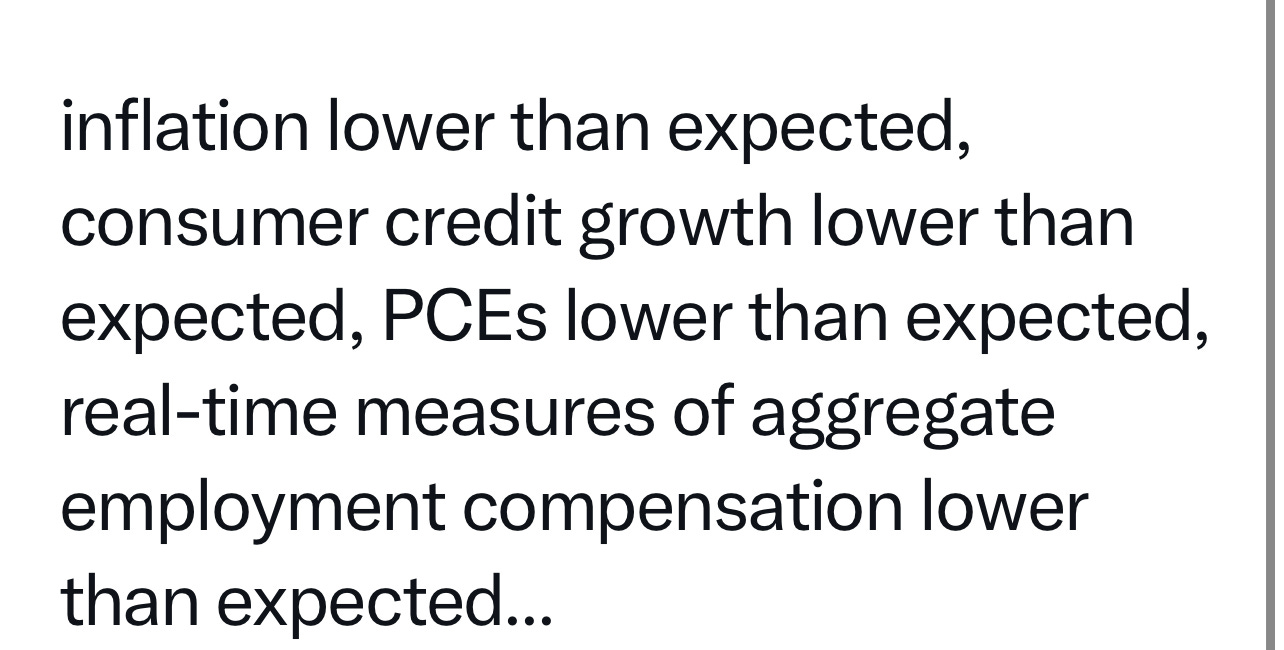

And the Economics “Team” is confirming that the Fed is much tighter than ebullient financial markets would lead the casual observer to conclude.